From Cash to Code: The Role of Digital Remittance in Unlocking Economic Growth

Digital remittance is a process of sending money electronically across borders using online platforms, mobile apps, or other digital methods, eliminating the need for traditional banking methods. In earlier times, remittances were a cash-focused domain, despite a reliance on bank transfers. With the advent of digital platforms and rise in their adoption, the digital remittance market has become one of the most fragmented financial service sectors for user experience, technology, and economic models.

Technological innovations for the facilitation of remittances exhibit great potential as they rely on existing systems of mobile phone networks and mobile banking services and hence are relatively easy to understand. Effective policies need to be necessitated to address the limitations in regulatory and financial infrastructure for mobile banking to become the foundation for mobile remittances.

Journey of Digital Platforms from Analogue to Algorithm

During the nineteenth and twentieth centuries, countries such as Spain, Italy, and Ireland were heavily dependent on remittances received from emigrants working abroad in countries such as the U.S., Argentina, and Australia. The first online-only remittance providers appeared on the scene more than 15 years ago with the widespread use of the internet. Over the past decade, fintech has helped transform international remittances, which traditionally involved lengthy and complicated processes that came with hidden charges. Money transfer operators & related fintechs have been a game changer, who have redefined the way people make cross-border payments. They have made global remittances fast, cost-effective, and accessible.

In the early 2010s, remittances represented the perfect entry point to financial services for various fintechs. High costs and complex regulatory systems, combined with an estimated $18 trillion of transfers across borders every year, led to the development of specialized businesses that eased the transaction process. However, currently digital remittance market is reaching a level of saturation, with less opportunities to stand out. To combat this situation, the industry is observing acquisitions and FinTechs turning into super-apps to enhance their offering.

According to 2023 Digital Remittances Adoption Report by Visa Inc., an American payment card company, approximately 800 million people rely on remittances to pay for essentials such as food, utilities, healthcare, and education; making these payments crucial for the global economy & the prosperity of developing communities around the world. According to the Visa report, 29 countries, including India, Mexico, China, Philippines, and Egypt, received over 10% of their GDP in remittances in 2022, while 7 received over 25% of their GDP. Furthermore, the report identifies the growth factors and barriers influencing the adoption of digital remittance. The study reveals that transacting money through current platforms has become easier as compared to traditional methods and the consumers see the future as digital. The emergence of digitalization has helped in solving remittance challenges, offering new business models and global network capabilities that bring speed, transparency, & cost savings.

Digital remittance adoption is significantly high across the U.S. and Canada. 60-70% of surveyed remittance users across North America have used an app-based digital payment method to send/receive money internationally, whereas only 10-15% of surveyed U.S. remittance users rely on cash, checks, and money orders. Research by the Visa Economic Empowerment Institute highlights the rise of digital remittances as digitally skilled migrant workers now have the power to easily compare providers & costs, allowing them to choose the best options for their families and ensure their money is transferred quickly & efficiently. Moreover, the study predicts that collaboration with private and public sectors can boost adoption of digital platforms globally.

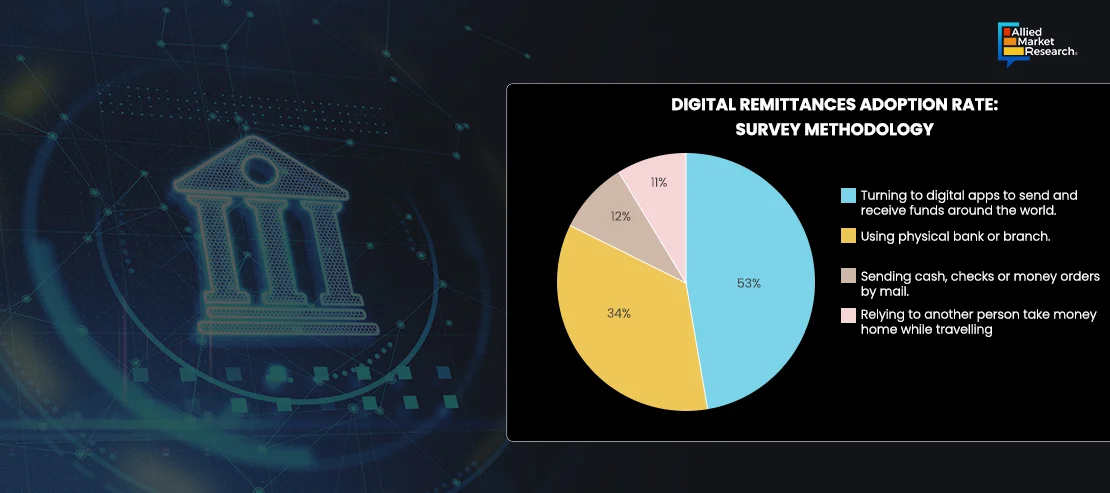

Digital Remittances Adoption Rate: Survey Methodology

The 2023 digital remittances adoption report survey was conducted by Visa and Morning Consult in December 2022. The report, which is based on a survey of over 14,000 consumers across 10 countries including the U.S., Canada, Mexico, Peru, France, Poland, Philippines, Singapore, United Arab Emirates, and Saudi Arabia. Within each country, survey participants were grouped on the basis of census estimates for age, race/ethnicity, gender, education, and region. In the survey, it was discovered that 53% of consumers use digital means, as compared to 34% of consumers who use a physical bank or money transfer branch. In addition, 12% of consumers send cash, checks or money orders in the post, while 11% rely on friends or acquaintances to take money home while travelling.

The Present: Developed and Technology-driven

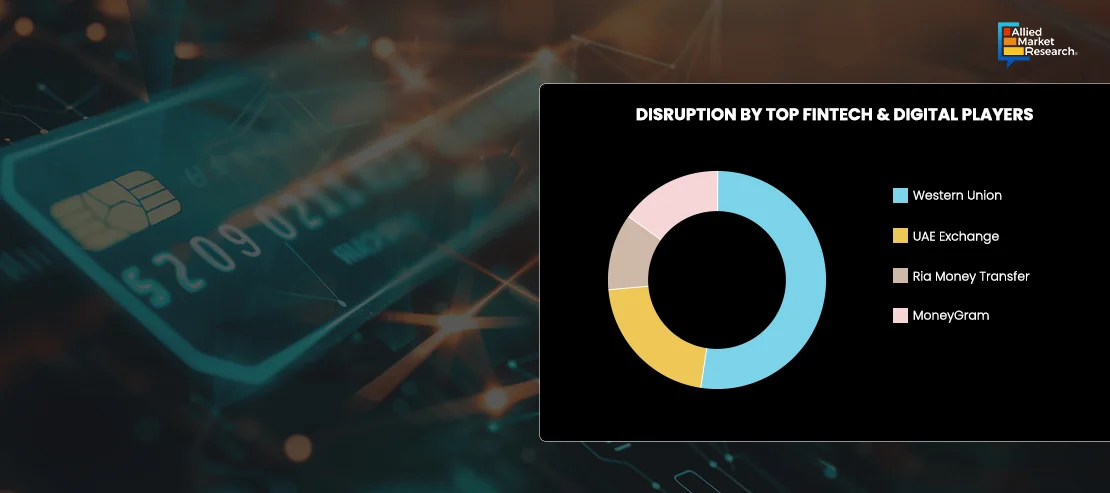

The adoption of digital remittance services became highly prominent during the COVID-19 pandemic. Advancements in mobile technology facilitated the proliferation of mobile wallets, allowing users to send and receive funds conveniently through their smartphones. Companies such as Western Union, MoneyGram, Ria Money Transfer, and UAE Exchange witnessed double volume of digital remittances on their annual returns.

These companies have been at the forefront in revolutionizing the digital remittance landscape with their user-friendly platform and competitive exchange rates. Moreover, these companies continue to invest in R&D to harness the full potential of emerging technologies, driving innovation, and reshaping the potential of digital remittance. Furthermore, new players such as PaySend, Xoom, and Remitly are using their low fees as a tangible factor to position themselves against incumbents. In addition, their business models are based on pure digital platforms which provide them with lower fixed costs and their modern, cleaner technologically operative platforms offer consumers quick turnaround times.

Blockchain technology in financial markets, including digital remittance market is significantly important to enhance the speed, transparency, and security of money transactions. The technology aids in decentralizing the ledger, hence allowing to track the transactions in real-time. In January 2021, Mobile Money, the Malaysian mobile wallet provider, and bKash, the mobile money provider in Bangladesh, collaborated through RippleNet, the global provider of cross-border payment. The aim of this acquisition was to empower the wallet-to-wallet payments between the two countries. Cryptocurrencies such as Bitcoin and Ethereum have established their position in the digital remittance market, especially in the countries where banking systems are unsteady. Cryptocurrencies are safe and cost-effective means to transfer money across borders. Remittance transactions though cryptocurrencies have enhanced safety as they employ decentralized protocols and vigorous cryptographic techniques,

Challenges: The Uneven Path Toward Digital Remittance

While digital remittance has boosted the money transaction process, its full-fledged adoption is bound by several challenges & limitations. The regulations regarding remittances are diverse across the globe such as anti-money laundering and know your customer (KYC) procedures, adhering to which becomes a difficult task for providers of digital remittance. To overcome this, standardization of regulations across countries is essential. Furthermore, the usage of common platforms globally can streamline the procedure.

Lack of proper infrastructure such as reliable internet connection also prevents the adoption of digital remittance in certain regions. This stresses upon the need to build adequate framework and provide individuals with the facilities which meet their requirements to send or receive remittances digitally. Moreover, digital platforms are highly prone to cyberattacks, positioning the money and financial details of users at high risk. To combat cyber threats, encryption of the platforms is mandatory. Enhanced due diligence and a risk-based approach should be adopted by service providers to strengthen the security & prevent frauds. Moreover, these threats call for large investments to enhance the technologies securing digital remittance platforms.

Future of Digital Remittance

Innovations in blockchain, AI, mobile banking, and biometric authentication are projected to enhance the future of digital remittance. AI is expected to be a game-changer for the industry as the speedy checks performed by it provide an understanding of user behavior and ensure fraud prevention. The market is yet to adopt cryptocurrencies completely, hence signifying a bright and promising future. Furthermore, in the coming years the market is projected to evolve from a standalone industry to a digital remittance product integrated with banking procedures. These robust solutions will enhance the convenience for users, preventing the juggle between banking application and remittance platform.

The roadmap for industry development involves collaboration between fintech companies, traditional financial institutions, and regulatory bodies to establish robust frameworks for compliance & interoperability. Digital awareness campaigns emphasizing the convenience, cost-effectiveness, and security offered by digital remittance solutions will be essential to boost the adoption among digitally inefficient population. As technologies continue to evolve and gain widespread acceptance, digital remittance is poised to revolutionize cross-border payments, making them faster, cheaper, and more accessible than ever before.

Conclusion

Digital remittance, as a novel and rapidly evolving phenomenon, is a promising field for future cross-border transactions. The expansion of the fintech sector and the proliferation of innovative digital solutions is expected to provide ample opportunities to elevate the offerings of cross-border remittances. Addressing key structural factors, such as tackling informality, improving financial inclusion, and aligning domestic regulatory frameworks with international standards, will be key to reaping the full benefits of new digital technologies globally.

For further insights, get in touch with AMR analysts!