Table Of Contents

- Personalized Investment Reshaping the Industry

- Resonating the Perks of Robot-advisory

- Robotics Technology to Gain Ground

- The Boom of Fintech

- Robo-advisory: Serving as Potent Fiduciary

- Robo-advisory Redefining Investment Advice

- Robo-advisory’s Receding Trust—the Most Important Asset

- Who Among the Below Financial Advisors do you Trust the Most?

- Fostering the Future of Financial Advising with Robo-led Services

Onkar Sumant

Koyel Ghosh

Robo-Advisory: A Realm Rebooting the Financial Sector

Robo-advisory refers to the provision of automated, algorithm-driven financial advice and investment services. This convergence of technology and financial expertise offers investment recommendations and portfolio management without the need for human intervention. Robo-advisory services utilize advanced algorithms to analyze an investor's financial situation, goals, risk tolerance, and other relevant factors to provide personalized investment strategies. These services have become convenient and widely used options for investors, as they provide instant affordability options to clients for investing into funds, thereby shaping the growth trajectory of the financial industry.

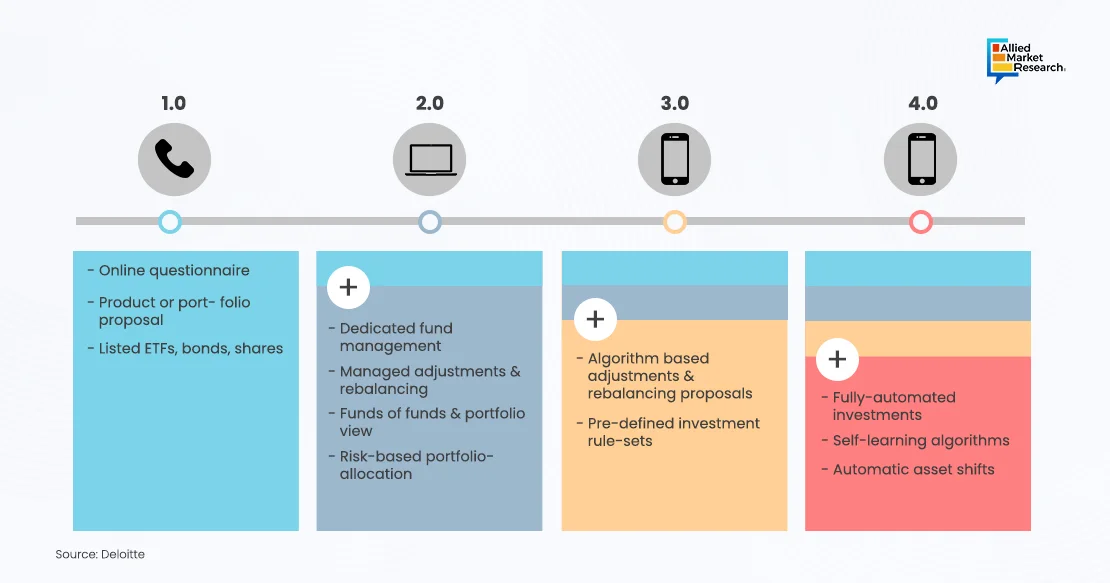

The evolution of robo-advisors from 1.0 to 4.0 reflects a progression toward personalization, sophistication, and integration of technology and human expertise to meet the evolving needs of investors. The advent of robo-advisors 1.0 in the early 2010s marked a milestone in the field of digital wealth management. These robo-advisors offer basic automated portfolio management—a low-cost alternative to traditional financial advisors—and allowed investors to access automated investment services with minimal human intervention & limited customization options. To offer enhanced personalization and facilitate goal-based investing, more sophisticated algorithms were incorporated in iteration 2.0, thereby offering deep insights into individual financial goals and risk preferences. For instance, some platforms introduced features such as automatic rebalancing and tax loss harvesting to optimize investment performance and tax efficiency. Version 3.0 involved the integration of AI and ML, enabling real-time portfolio adjustments and enhanced predictive analytics. The latest version, 4.0 is a convergence of human advisors alongside automated algorithms, creating hybrid advisory models. It is characterized by advanced features such as natural language processing for better client communication, expanded asset classes, including alternative investments, and increased emphasis on sustainability and ethical investing, thus providing a more holistic and tailored wealth management experience.

Personalized Investment Reshaping the Industry

Traditionally, robo-advisors offered algorithm-driven, one-size-fits-all investment portfolios based on generic risk profiles. However, personalized investment is reshaping the robo-advisory industry by enhancing the level of customization and tailoring investment strategies according to individual needs and preferences. In addition, with advancements in data analytics and integration of AI, robo-advisors now have the capability to analyze massive volume of data, including financial habits, goals, and risk tolerance of individual investors. This allows them to offer more personalized investment recommendations, thus optimizing asset allocation and investment decisions to better suit the unique circumstances of each client. Moreover, the integration of ML algorithms enables robo-advisors to continuously learn and adapt to changing market conditions and investor preferences, ensuring ongoing optimization of investment strategies. As a result, personalized investment is not only enhancing the value proposition of robo-advisory services but also attracting a broader range of investors seeking tailored financial solutions. For instance, Vanguard, a provider of investment management services, offers "personal advisor services," which serve as a robo-advisory platform that combines automated investment advice with access to human advisors. Vanguard reported significant growth in its robo-advisory service, which highlights the increasing demand for such solutions.

Resonating the Perks of Robot-advisory

Robo-advisory services offer several advantages across different segments of the financial industry. They significantly enhance accessibility and affordability, allowing more people to benefit from professional financial advice by lowering fees compared to traditional advisors. The automated nature of these services ensures that even those with smaller investment portfolios can receive tailored advice. Moreover, robo-advisors provide personalized investment management by using sophisticated algorithms that analyze individual user profiles, including financial goals, risk tolerance, and investment timelines. This personalization is combined with continuous portfolio monitoring and automatic rebalancing, ensuring optimal performance and alignment with the user's objectives. Furthermore, robo-advisors often incorporate features such as tax loss harvesting to improve tax efficiency, offering a comprehensive and cost-effective solution for investors across various financial sectors.

Robotics Technology to Gain Ground

Robo-advisors offer several advantages over human financial advisors, making them an increasingly popular choice for investors. One of benefits includes cost-effectiveness; robo-advisors typically charge lower fees than traditional advisors, making professional financial management accessible to a broader audience, including those with smaller investment portfolios. Furthermore, robo-advisors provide enhanced accessibility and convenience, allowing users to manage their investments online at any time without needing to schedule appointments. They also offer a high degree of personalization by using sophisticated algorithms to create and manage tailored investment portfolios based on individual financial goals and risk tolerance. Moreover, they ensure continuous portfolio monitoring and automatic rebalancing, maintaining optimal asset allocation without requiring manual intervention. These services often include advanced features such as tax-loss harvesting, which can improve tax efficiency.

The Boom of Fintech

Fintech technologies aim to enhance financial inclusion, improve customer experience, streamline processes, reduce operational costs, and drive overall efficiency and competitiveness in the financial sector. Automation and efficiency lie at the core of fintech innovations, enabling robo-advisors to streamline investment processes, reduce costs, and scale operations seamlessly. This efficiency makes robo-advisory services more accessible to a wider audience, democratizing wealth management. Fintech advancements further facilitate personalized investment solutions by harnessing data analytics and AI. These technologies empower robo-advisors to analyze vast amounts of data swiftly, providing tailored investment recommendations aligned with individual investors' goals and risk profiles. Fintech's focus on enhancing user experience has revolutionized the way investors interact with financial services. Intuitive interfaces and mobile applications offered by fintech companies have made robo-advisory platforms more user-friendly and engaging, particularly appealing to tech-savvy investors.

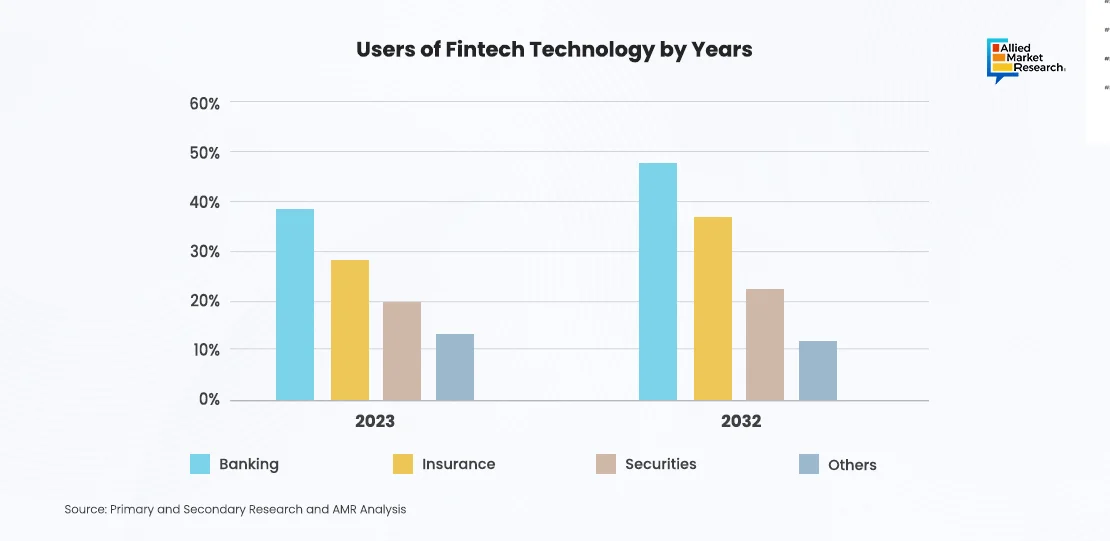

The adoption of fintech technology has seen remarkable growth, with a significant percentage of users embracing various digital financial services. The above figure depicts that over 38% of banking consumers have utilized at least one fintech service in 2023, as consumers increasingly prefer the convenience and efficiency of digital banking, mobile payments, and investment platforms. Insurance also shows substantial adoption rates, typically ranging from 25% to 29%, as it offers risk mitigation by providing a safety net against unforeseen events such as accidents, illnesses, natural disasters, or even death.

Thus, robo-advice in fintech offer a cost-effective, efficient, and accessible means of personalized investment management, encouraging individuals to achieve their financial goals with ease and precision.

Robo-advisory: Serving as Potent Fiduciary

The integration of AI and ML enable robo-advisors to offer more personalized and sophisticated financial advice based on real-time data analysis and predictive analytics. This advancement allows for more accurate risk assessments and tailored investment strategies, improving client outcomes. Moreover, the incorporation of natural language processing is enhancing customer interactions by providing more intuitive and conversational interfaces.

Furthermore, robo-advisors are expanding their services beyond traditional investment management to include holistic financial planning, such as retirement planning, tax optimization, and estate planning. This diversification is attracting a broader client base, including those who may not have previously engaged with financial advisory services. The industry is also seeing a push toward democratizing access to financial advice. Lower fees and reduced minimum investment thresholds are making robo-advisory services accessible to a wider audience, including younger and less affluent investors. This democratization is fostering financial inclusion and empowering more individuals to manage their wealth effectively.

Robo-advisory Redefining Investment Advice

As awareness regarding the benefits associated with investing and managing finances is increasing significantly, robo-advisors are likely to play a pivotal role in providing accessible and user-friendly platforms for learning and investing. This educational aspect could include tools and resources to help investors understand complex financial concepts, learn about different investment strategies, and track their progress over time. Moreover, the integration of robo-advisory services with other financial products and platforms is expected to accelerate. For example, robo-advisors are likely to seamlessly integrate into banking apps, retirement accounts, and employer-sponsored retirement plans, making automated investing more accessible and convenient for a wider range of individuals. This integration could also lead to enhanced financial planning capabilities, allowing investors to synchronize their investment strategies with their broader financial goals, such as saving for retirement, buying a home, or funding their children's education.

Furthermore, the role of human advisors in conjunction with robo-advisory services is an area of ongoing exploration. While robo-advisors offer scalability, efficiency, and cost-effectiveness, human advisors bring a level of empathy, emotional support, and nuanced financial guidance that automated platforms may struggle to replicate fully. Therefore, a hybrid model is expected to emerge in the coming future, where robo-advisors and human advisors work collaboratively to provide comprehensive wealth management solutions that combine the best of both worlds.

Robo-advisory’s Receding Trust—the Most Important Asset

Robo-advisors offer numerous advantages over human financial advisors, including cost-effectiveness, accessibility, and continuous portfolio management. Despite the promising future, robo-advisory services face several challenges as they continue to evolve. For instance, an important factor to consider is the element of trust that many people place in human advisors. Trust in human advice often stems from personalized interactions, the ability to ask questions and receive immediate responses, and the reassurance of human expertise during volatile market conditions.

To prevent potential risks and abuses, investors should carefully understand and assess the investment advice offered by robo-advisors. Although not widespread, there have been reports of inappropriate investment advice, wherein customers have claimed that they have suffered substantial losses, as robo-advisors failed to evaluate their risk tolerance and investment goals. Thus, robo-advisors are losing trust, the most important assent of a financial advisor. This, in turn, is increasing the reliance and trust on human advice than on robo-driven advices. According to the surveys conducted between 2022 and 2023, about 74% of retail investors rely on human advice. Thus, human financial experts are the most reliable source for financial information as compared to online research, academic authorities & books, friends & family, social media, and employers’ retirement plan providers. By taking into consideration the emotional quotient to financial advising, Carla Dearing—the CEO of SUM180, an online financial planning service—says that “money is emotional and there are always intangibles to consider in deciding what to do next, which cannot be captured by robots.” Although robo-advisors are not far behind human advisors, advice is still the forte of humans, which cannot be surpassed by algorithms alone, thereby making human aspect of advising an important factor.

Who Among the Below Financial Advisors do you Trust the Most?

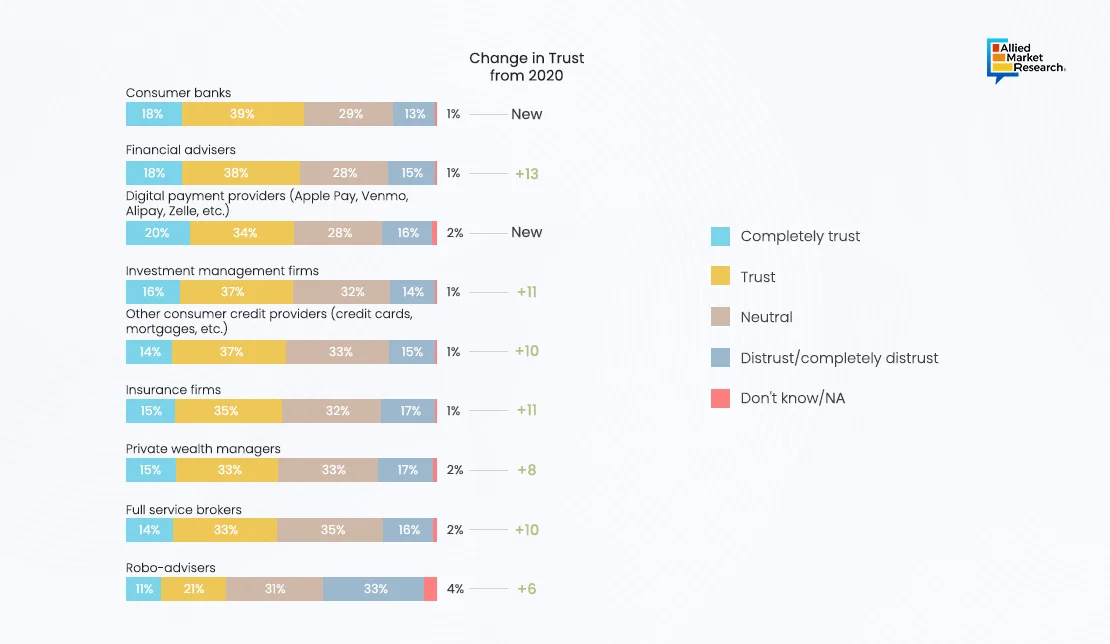

This image highlights the trust that individuals often have in human advisors. Consumer banks serve as the most trusted segment of financial advising, depicting 57% complete trust. Although robo-advisors have been gaining trust after 2020, they still lie at the end of the trust spectrum, showcasing less than one-third of complete trust.

Despite this, robo-advisors are increasingly building trust through transparency, robust algorithms, and the integration of human elements such as customer service representatives who can provide support when needed. Moreover, many robo-advisory platforms include educational resources and detailed explanations of their strategies, helping users to feel more informed and confident in their investment decisions. As robo-advisors continue to evolve, they are increasingly focusing on enhancing user trust through improved technology, transparency, and the option to consult with human experts when necessary, bridging the gap between automated efficiency and personalized service.

Another significant challenge is data privacy & security. Any breach or laps in security could erode trust and confidence in robo-advisory platforms, leading to reputational damage and potential loss of clients. With the increasing reliance on technology and data analytics, robo-advisors must demonstrate robust cybersecurity measures and transparent data handling practices to reassure clients about the safety of their personal and financial information. To overcome the current challenges faced by robo-advisory services, a multifaceted approach is necessary. Enhancing the sophistication and personalization of algorithms can address the need for more tailored financial advice, making robo-advisors more appealing to a broader range of investors. Integrating AI and ML can help achieve this by analyzing more complex data sets and offering nuanced recommendations. Thus, improving user trust and transparency is crucial. This can be done by ensuring robust cybersecurity measures, clearly explaining how algorithms make decisions, and maintaining transparency about fees and potential risks.

Fostering the Future of Financial Advising with Robo-led Services

Robo-advisory services represent a significant evolution in the wealth management industry, offering investors accessible, cost-effective, and technologically driven solutions for investment management. By leveraging data analytics, AI, and automation, robo-advisors can provide personalized investment recommendations tailored to individual preferences and goals. While the industry faces challenges such as increased competition, regulatory uncertainty, and trust issues, the potential for innovation and growth remains high. As robo-advisory services continue to evolve, striking a balance between automation and human interaction, addressing algorithmic biases, and maintaining transparency and compliance will be essential for ensuring the long-term success and viability of automated investment platforms.

For further insights, get in touch with AMR analysts.