Growth Prospects of Liquid Synthetic Rubber Applications in Transportation Industry

Liquid synthetic rubber is an artificial elastomer, which is produced from the by-products of petroleum. It is polyurethane in liquid state that exhibits enhanced flow properties superior abrasion resistance as compared to natural rubber. This elastomer finds its major application in industrial rubber manufacturing, tire manufacturing, polymer modification, and adhesive manufacturing. Products such as liquid isoprene, liquid butadiene, and liquid styrene butadiene are made with its help.

Current Adoption of Liquid Synthetic Rubber

The increase in the application of the product in the tire manufacturing sector is a major factor driving the adoption of liquid synthetic rubber. Moreover, growth of the automobile industry across countries such as Germany, India, & China and rise in demand for electric vehicle across the globe have led to surge in demand for tires, which, in turn, is expected to foster the demand for this form of liquid polyurethane among the tire manufacturers. In addition, surge in investment from the emerging economies, such as China and India, toward the development of housing infrastructure augments the demand for adhesives, which eventually is likely to boost the demand for this elastomer. According to a study by Allied Market Research, the liquid synthetic rubber market is anticipated to grow at a CAGR of almost 8% from 2023 to 2032.

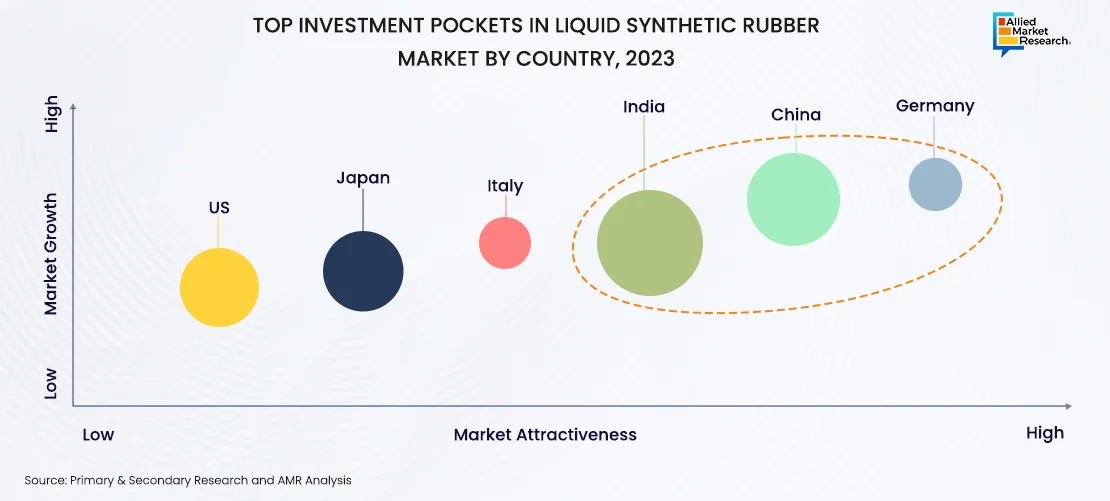

China, India, and Germany to Lead the Adoption

China, India, and Germany served as the top investment pockets for investors to capitalize in 2023. The expansion of the automotive industry, which is a major consumer of this elastomer in Europe and Asia-Pacific, is predicted to augment the adoption of liquid synthetic rubber in the regions. Furthermore, the presence of major tire manufacturing companies across these regions, such as Bridgestone, Michelin, Pirelli, & Apollo, and innovative manufacturing techniques incorporated by the manufacturers are expected to contribute toward the growth of liquid synthetic rubber market.

Furthermore, rapid development of the manufacturing sector in the emerging economies, such as China and India, primarily automotive and construction sector, is expected to propel the growth of liquid synthetic rubber market during the forecast period. For instance, the Indian automotive industry produced 5.46 million units of vehicles in 2022 registering a YoY growth of 24% as compared to 2021, while the Chinese automotive industry produced 27 million units of vehicles in 2022 registering a YoY growth of 3.5% as compared to 2021. With the growth of the automotive end-use industry, the demand for tires is expected to increase considerably in the coming years. Hence, the use of liquid synthetic rubber, mainly in tire production, is also anticipated to witness high growth in the coming years.

Use Cases Across Various Industries

Liquid synthetic rubbers have found application across a diverse array of industries, leading to a growth in demand, production, and usage on a global level.

Liquid synthetic rubber is widely used in tire production, as it reduces viscosity, minimizing migration while improving the processability of the rubber compound in tire. The automobile industry has been experiencing robust growth due to rapid industrialization, which has led to an increase in sale of commercial vehicles such as trucks, tractors, and trailers. In addition, the rise in disposable income and improvements in standard of living have increased the sale of luxurious passenger cars, premium segment and aircraft (aerospace industry) bikes.

Furthermore, electric vehicle sales are expected to increase in the coming years. Furthermore, decrease in prices of electric vehicle parts such as battery, transmission, and alternators, propels the sale of electric vehicles. Thus, the rise in demand for vehicles for private or commercial use has led to a rise in automobile and tire production. Moreover, the global consolidation of the automotive sector that results in mergers and acquisitions among international and domestic vehicles manufacturers boosts the growth of the automotive sector, thus fostering the demand and production of tires.

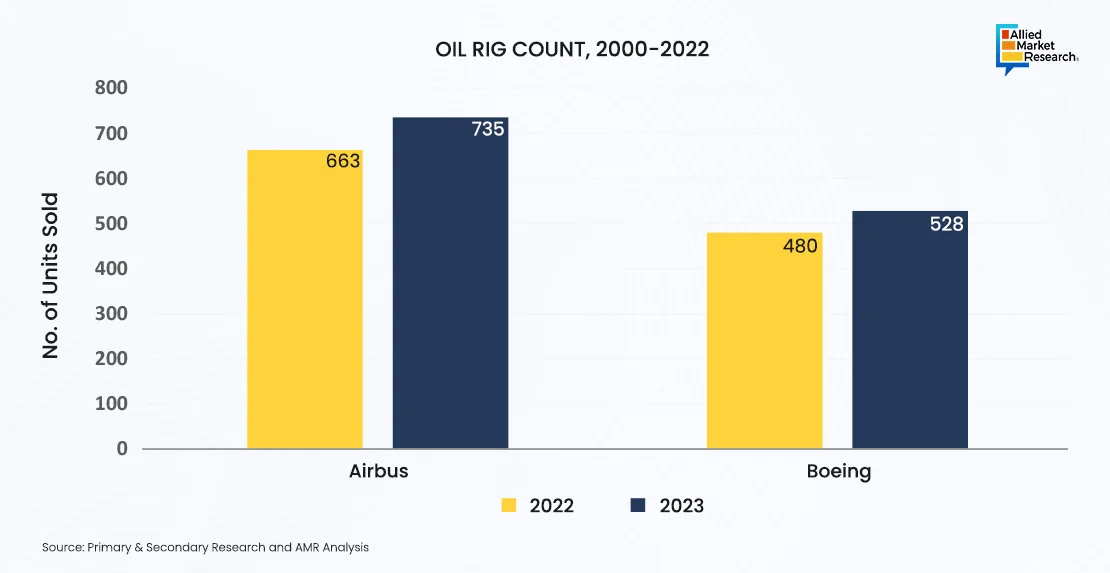

Moreover, with the growth of the travel industry post COVID-19, the air travel industry has been showcasing constant growth on an annual basis, which has led to the expansion of the aerospace tire industry. Airline companies are placing bulk orders for various aircraft, mainly from Boeing, Airbus, Embraer, and others. Therefore, growth of the automobile and aerospace sector is expected to increase the overall production of tires, which eventually is anticipated to drive the demand for liquid synthetic rubber during the forecast period.

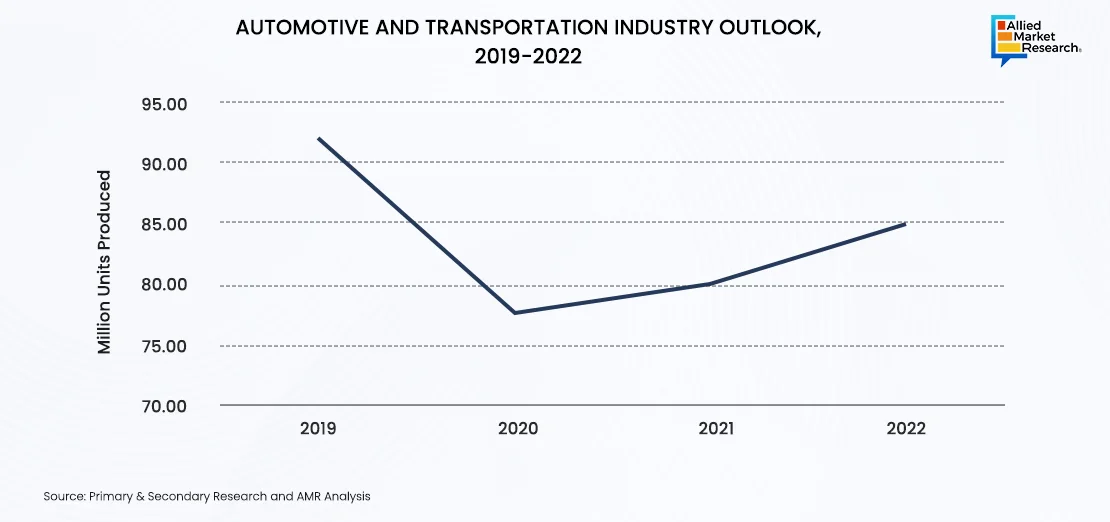

Post COVID-19, the automotive and transportation industry witnessed a growth of 3% in 2021 and 6% in 2022, after declining by more than 15% in 2020. Asia-Pacific has emerged as a hub for automotive production as manufacturers such as BMW AG (Germany) and Volkswagen Group (Germany) have already set up manufacturing units in this region. The factors such as low production costs, availability of economic labor, lenient emission & safety norms, and government initiatives for foreign direct investments have led to significant investment in Asia Pacific. In addition, Asia-Pacific is a hub of major tire manufacturers such as Bridgestone Corporation (Japan), Kumho Tire Co. (South Korea), Toyo Tire & Rubber Co., Ltd. (Japan), the Yokohama Rubber Co., Ltd. (Japan), Sumitomo Rubber Industries Ltd. (Japan), Hankook Tires (South Korea), and other Tier-1 suppliers.

As per the above figure, Airbus produced the highest number of commercial aircraft in 2022 and is expected to continue in the coming years. Airbus and Boeing registered a growth of more than 10% YoY between 2022 and 2023. Passenger demand (travel) witnessed significant growth in 2023, driven by the reopening of China to both inbound and outbound travel. This surge in travel is expected to counterbalance economic challenges in other regions worldwide. A 21% increase in revenue passenger kilometers (RPKs) in 2023, followed by 17% in 2024 is expected to take global traffic above the 2019 level, bringing forward the recovery horizon by 12 months compared to earlier expectations.

Sustainability Concerns to Deliver a Potential Investment Ground

Synthetic rubber is manufactured using petroleum products. With many countries and organizations announcing net-zero targets, and to become climate-neutral by 2050, the need for conservative elastomers and the rubber industry to invest in technologies have grown considerably. The industry is expected to gradually deal with stricter government regulations pertaining to emissions reductions as more end-users and climate change organizations seek net-zero plans and demand zero-carbon supplies and services. This is a major opportunity for various manufacturers to revamp current processes towards providing more flexibility, differentiation, and cost-effectiveness, complying with different regulations and recommendations. Moreover, these capital expenditure projects such as production process upgrade, capacity expansion, employee skill development and others will not only reduce the impact of synthetic rubber production on the environment but also minimize community impacts, secure social licenses to operate, and reduce the production costs. For instance, in 2023, EVE Rubber Institute entered into an agreement with Ecombine Advanced Materials and Arlanxeo High Performance Elastomer for delivering innovations in liquid-phase mixing and to explore synthetic rubber applications for use in tire production.

Future Outlook and Growth Scope

The industry tends to witness ongoing efforts in diversifying product offerings and innovating new forms of synthetic rubber. If liquid synthetic rubber aligns with eco-friendly or sustainable alternatives, the market is expected to gain traction due to increased emphasis on environmentally conscious products. Global economic conditions, technological advancements, and changes in consumer behavior impact the trends within the synthetic rubber market. Thus, advancements in technology with respect to liquid synthetic rubbers are expected to provide prospects for the expansion of the global liquid synthetic rubbers market in the future years.

For further insights, get in touch with AMR analysts.