Table Of Contents

Yerukola Eswara Prasad

Pooja Parvatkar

Potential of Firefighting Foam: Revolution in Oil & Gas Industry

Firefighting foams are a mixture of air, water, and concentrations that suppress fire by forming a layer that acts as a shield between fuel/source and oxygen. Fire outbreaks and accidents have shown a significant increase in the last few years, which has led to many preventative measures that are being adopted by several companies. Furthermore, government and organizations are also mandating several safety measures that are to be followed by industries prone to fire outbreaks, given the working conditions of the unit or facility. Companies are mandated to stock the required number of firefighting foams and are advised to take part in mock fire drills and disaster management training. For instance, North America has several rules and regulations that prohibit the use of PFOS and PFAS containing firefighting foams, owing to the contamination of drinking water sources and harmful effects on human health. For example, Washington became the first state to prohibit the sale of PFOS and PFAS firefighting foams since July 2020.

During fire suppression, the polymer from the foam precipitates and forms a barrier or membrane between fuel surface and foam blanket, which prevents damage from alcohol fuel. Many oil & gas and marine industries use this foam in massive quantities due to involvement of highly flammable liquids or fuels, which contain alcohol.

Global Scenario of Firefighting Foam Market

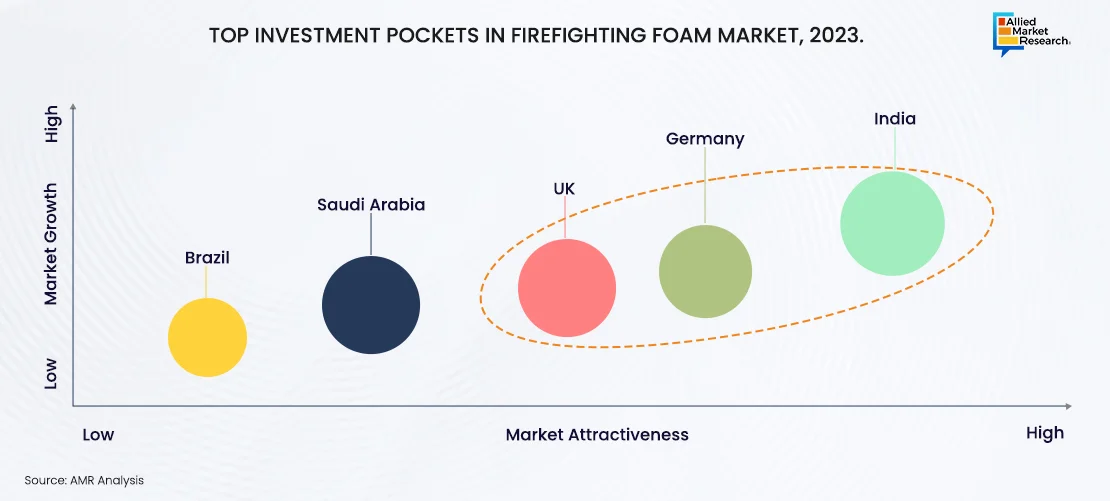

India, the U.K., and Germany are top investment pockets in the global firefighting foam market owing to several factors such as increased government investments, demand from developing economies, and growing oil & gas industry. The presence of various manufacturing factories and plants in the country drives the demand for firefighting foam, owing to strict rules and regulations regarding fire hazard safety. Meanwhile, in Germany, Bundeswehr Research Institute for Protective Technologies and NBC-Protection is testing for experimental siloxane-based AFFF, which is expected to have lesser environmental effects, thus offering lucrative opportunities for the growth of the firefighting foam industry. According to a study by Allied Market Research, the global firefighting foam market is anticipated to register a CAGR of 3.6% between 2020 and 2027.

Industrialization Outlook

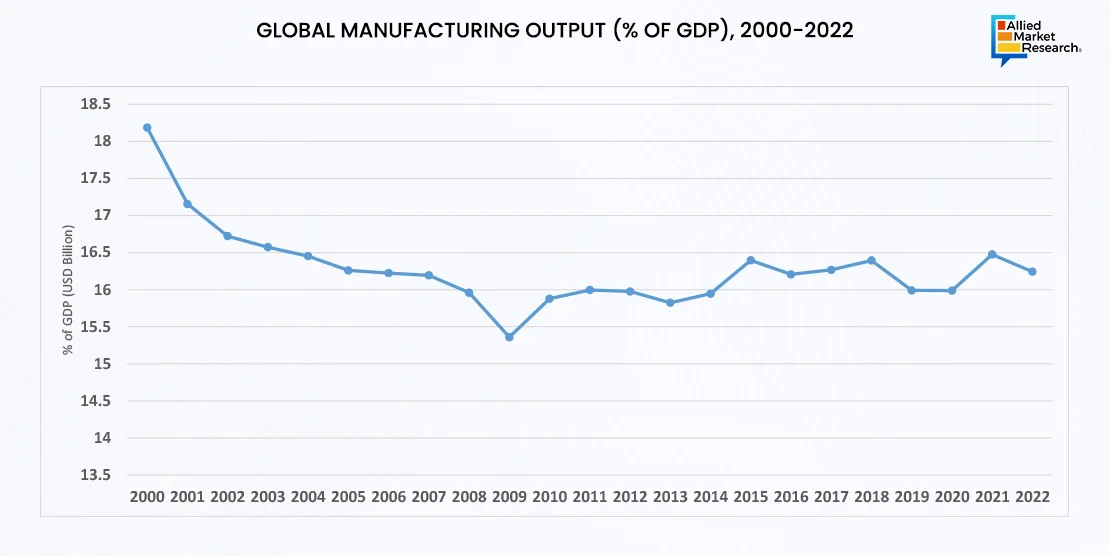

In recent years, the level of industrialization has witnessed continued growth except between the years 2008 and 2015. Increase in industrialization has led to increase in country GDP and overall global GDP. Since 2000, globalization has accelerated, leading to the outsourcing of manufacturing jobs from developed countries to emerging economies with lower labor costs, such as China, India, and Southeast Asian countries. This has transformed the industrial landscape, with significant portions of manufacturing now concentrated in these regions.

Oil & gas, chemical manufacturing, and electrical end-use industries are some of the manufacturing sectors, which deal with hazardous and inflammable materials. Moreover, there are instances where major fire incidences have occurred leading to loss of lives or property. For instance, in February 2010, large explosions occurred at a Kleen Energy Systems (620-megawatt), a gas- and oil- fired power plant in Middletown (CT), U.S. In March 2010, a fire occurred in natural gas containers at the Ichihara oil refinery in Japan. Due to such instances, various governments have formed regulatory framework for use of fire protection materials and procedures. In such instances, it is always recommended to use firefighting foam to contain the spread of fire, which may lead to further eventualities.

Oil & Gas Industry Outlook

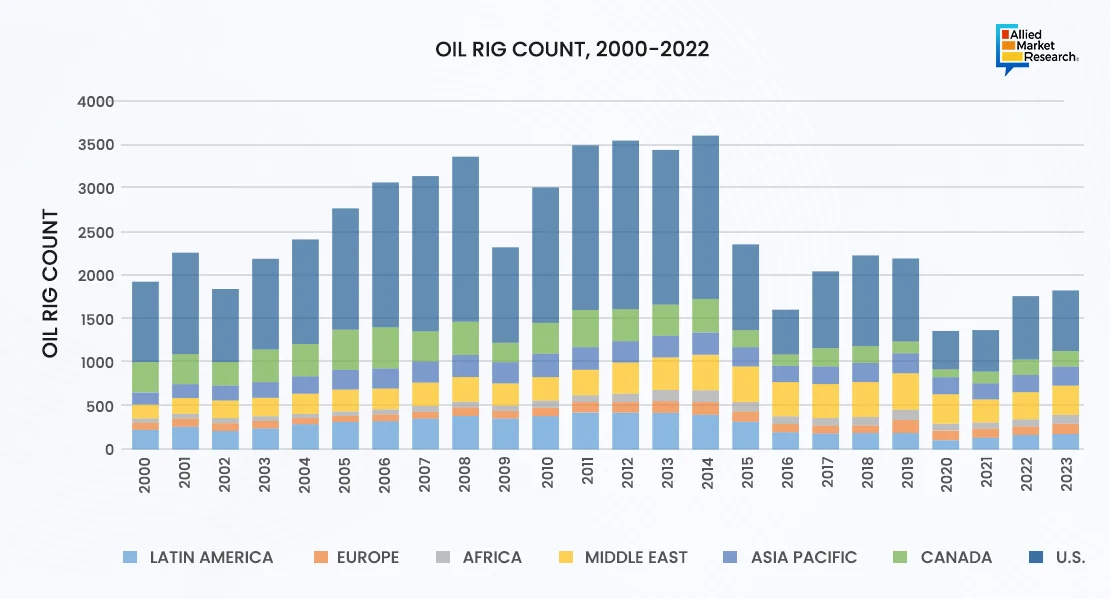

Oil & gas industry is one of the major end users that contributes significantly to the global GDP. The oil and gas industry deals in hazardous and highly inflammable materials in nature. Chances of a major fire-related issue in an oil rig (on-shore and off-shore) are always high; hence these oil rigs have to be prepared for any such eventualities. The use of foams is largely concentrated in this industry as they are prone to fire outbreaks owing to the nature of industry. Oil & gas companies need to comply with several stringent rules & regulations regarding fire safety, which drives the growth of the firefighting foam market.

The above figure highlights the total oil rigs (onshore and offshore) count globally. The highest count of oil rigs was registered in 2014 totaling 3578 rigs.

Hazards and Risks

There have been many fire-related incidents in the oil and gas industry in the past years. Fire causes owing to component failure such as valve, sensor, pipes, drill rigs and others, human error, natural calamity, and others have created a dangerous atmosphere in oil rig platforms. Thus, government bodies have formed rules and regulations to mitigate these issues. For instance, in the U.S. Department of Labor (Occupational Safety and Health Administration), cited standards for oil and gas industry covered by 29 CFR 1926 and 29 CFR 1910 Act. By compliance with these regulations and recommendations, work environment safety is bound to increase, thus protecting employee lives and properties. Even in such cases, there have been numerous fire related incidents in the oil & gas industry as mentioned below:

Significance of Firefighting Foam

Owing to various instances of fire, it is always recommended to use foam for dousing the flames. Alcohol resistant aqueous film forming foam (AR-AFF) are viscous concentrates. They are developed especially for fires caused by flammable and water-soluble liquids. The foams form a gel like appearance, which is normal for the AR-AFFF. The foam blanket forms a polymeric membrane on a polar solvent fire. Owing to the presence of polymers in the concentrate, the foam blanket forms an invisible gel like appearance on the surface of liquid. During fire suppression, the polymer from the foam precipitates and forms a barrier or membrane between fuel surface and foam blanket, which prevents damage from alcohol fuel. Many oil & gas and marine industries use this foam in enormous quantities due to involvement of highly flammable liquids or fuels, which contain alcohol. Thus, it drives the firefighting foam market.

Future Outlook and Growing Market Scope

The firefighting foam market underscores the dynamic nature of the industry, shaped by evolving regulations, technological advancements, and increasing emphasis on environmental sustainability. As stakeholders navigate these shifts, a proactive approach that incorporates innovation, regulatory compliance, and environmental responsibility will be essential for maintaining competitiveness and meeting the evolving needs of the market. By embracing emerging trends and leveraging opportunities for sustainable growth, stakeholders can position themselves effectively. For further insights, get in touch with AMR analysts.