BFSI: Top 5 Emerging Markets by Allied Market Research in Q2’24

The BFSI sector has transformed by the adoption of innovative technologies like Artificial Intelligence, Machine Learning, and Blockchain. Digital banking platforms, mobile payment solutions, and online insurance services have enhanced customer experience and boosted operational efficiency. From equity management software to extended warranties, advanced technologies have revolutionized every operation in the domain. This FinTech evolution has enhanced the precision and efficiency of financial processes among various industries.

Allied Market Research has identified the top 5 emerging markets in the BFSI industry using its Title Matrix Tool. This tool relies on a mix of research parameters, current events, CAGR values, recent developments, and market revenue figures in the sector. The top 5 markets are analyzed in detailed research reports, covering industry size, forecasts, and key players. By offering both historical data and future outlook, these reports provide a detailed overview of each market and assist investors in making informed decisions.

Remittance market

The rise in digital transformation within the payment industry has increased the adoption of mobile money and online payment platforms, enhanced the convenience of remittance, and contributed to market growth. As per the report by Allied Market Research, the remittance industry is anticipated to showcase the fastest growth with a 5.8% CAGR by 2032. Research on the remittance market is crucial as technology adoption grows, ensuring safer transactions. Additionally, constant regulatory changes impacting the market are essential factors to consider in the study.

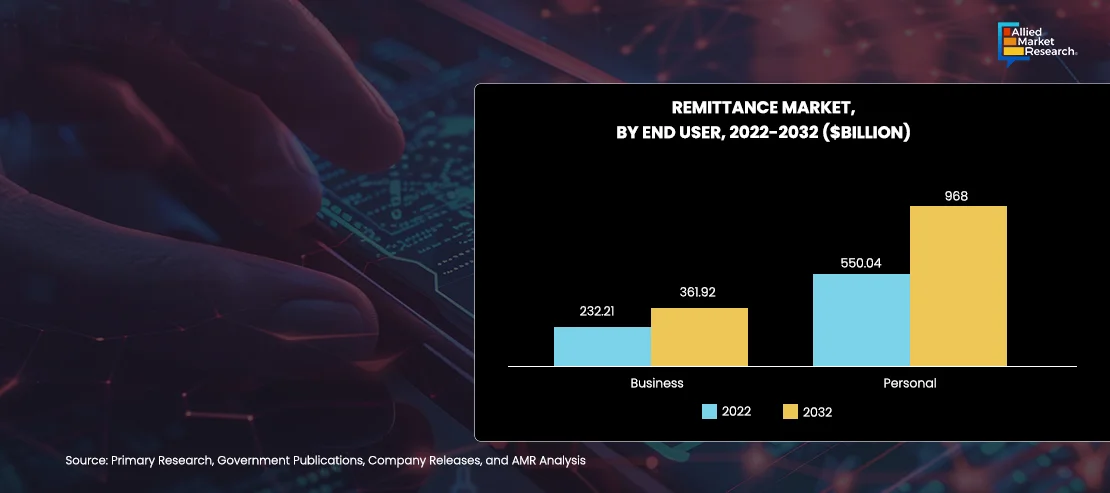

The segmental analysis section involves the categorization of industries on a different basis. The remittance industry is segmented across remittance channels, application, and end user. It also discusses the highest revenue generating and fastest growing segments among each category to assist stakeholders. For instance, based on end-user, the personal segment generated the highest revenue in 2022 and is projected to maintain its leadership throughout the forecast timeframe. The rise of digital payment channels and mobile money services has made it easier and more convenient for people to send money across borders to support their loved ones.

Travel Insurance Market

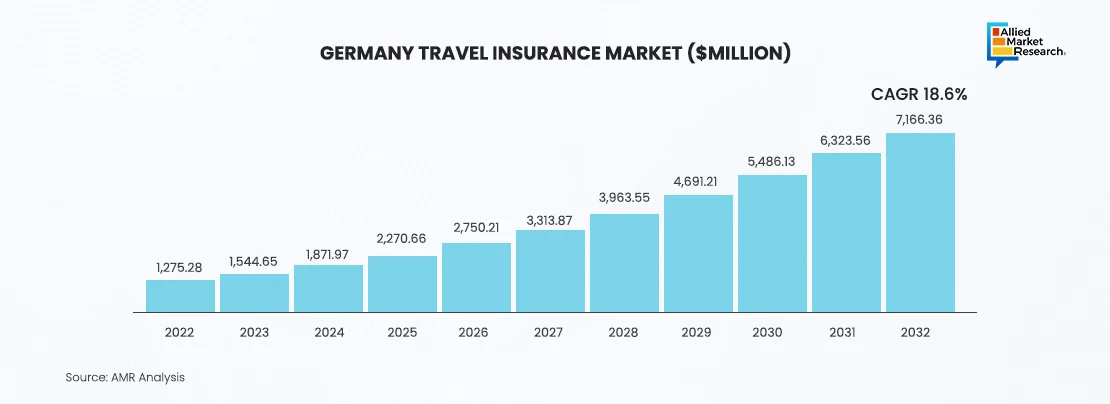

The travel insurance industry is projected to generate an absolute revenue of $106.8 billion with a notable CAGR of 20.1% by 2032. The growth of the market is fueled by globalization and an increased rate of travel among the global middle class, combined with the mandatory requirement of travel insurance in several countries. The increasing focus of insurance providers on enhancing customer experience through improved claim settlement processes and offering customized plans has created the opportunity for research on the travel insurance market.

The report also includes a detailed regional analysis of the market, covering the regions of Asia-Pacific, LAMEA, Europe, and North America. It discusses the driving factors and market opportunities in each region. For instance, the European region dominated the industry in 2022 due to the region's high travel frequency among its population, strong awareness about the importance of travel insurance, and well-established travel infrastructure. Among the European countries, Germany is anticipated to cite promising growth throughout the forecast timeframe.

Aviation Insurance Market

Aviation insurance generally includes coverage for different types of risks associated with aviation, including insurance for aircraft hulls and liability, passenger and product liabilities, hangar keeper's responsibilities, and in-flight insurance for both passengers and crew members. The aviation safety regulations by government and the global standardizations in the insurance industry highlight the importance of research on the global aviation insurance market.

Allied Market Research’s report on the aviation insurance market generated $4.1 billion in 2022 and is estimated to garner an absolute revenue of $7.1 billion by 2032. The aviation insurance sector is significantly shaped by the rising emphasis on green aviation initiatives, particularly the development of sustainable aviation fuels, which are increasingly impacting the global aviation insurance landscape.

Examining historical data, trends, and events is essential for understanding past developments in the aviation insurance industry. This involves analyzing adoption rates, technological advancements, regulatory changes, and industry performance. Retrospective analysis provides a comprehensive understanding of past trends and current dynamics in the connected ship industry, enabling stakeholders to make informed decisions and strategic investments.

Equity Management Software Market

The growing demand for reports on the equity management software industry stems from companies' heightened focus on automating and enhancing efficiency in their equity management processes, benefiting both the organization and its employees. AMR’s report on the equity management market states that the industry is expected to display a growing CAGR of 14.3% by 2032. Understanding market dynamics and emerging trends enables businesses in the equity management software market to capitalize on opportunities and effectively address challenges.

The report provides a comprehensive competitive analysis of the equity management industry, including the top business entities and their strategic alliances. This analysis comprises leading entities including Eqvista, Carta, Certent, Ledgy, ALTVIA SOLUTIONS, LLC, DEEP POOL Financial Solutions Limited, Preqin Solutions, Capdesk, Euronext, and Gust. These organizations are heavily investing in R&D activities to propel the industry with their diverse product offerings and strategic partnerships. This information about key players in the industry provides businesses with valuable insights for making strategic decisions.

Porter's Five Forces analysis of the industry emphasizes the importance of financial factors in shaping business growth strategies. It also highlights the influence of buyers and suppliers, enabling stakeholders to make profit-centric decisions and strengthen their supplier-buyer networks.

Extended warranty market

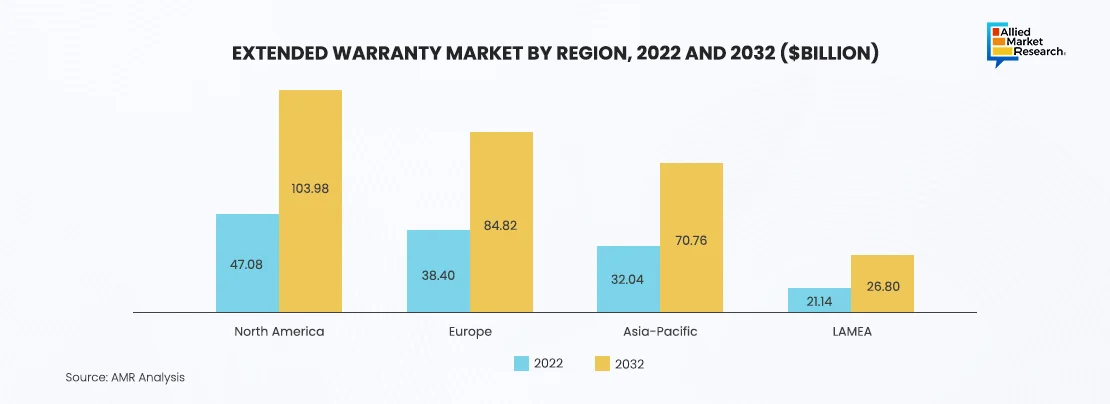

An extended warranty, also known as a service agreement, service contract, or maintenance agreement, is a policy that extends the warranty period of consumer durable goods beyond the original warranty provided by manufacturers at the time of purchase. The extended warranty market is witnessing transformation due to surging product complexity, an increase in penetration of electronics, and a rise in awareness regarding extended warranty. The industry is projected to hold absolute revenue of $286.4 billion from 2023 to 2032.

An integral component of the AMR report is the regional analysis of the market, which evaluates the performance of the industry across different regions of the globe, encompassing North America, LAMEA (Latin America, Middle East, and Africa), Asia-Pacific, and Europe. As per the regional analysis of the extended warranty industry, North America garnered the highest market share in 2022 and is anticipated to maintain its dominance throughout the forecast timeframe. The growth is attributed to the presence of extended warranty providers and a surge in penetration of electronic production.

Exploring the Expanding landscape of the BFSI domain

The primary goal of publishing the AMR study on the top 5 emerging markets in the BFSI sector is to assist businesses in comprehending the evolving landscape of the industry, enabling them to develop novel strategies. The actionable data and market intelligence offered in these reports empower companies to assess their performance and gain insights into the shifting dynamics of the sector. For instance, a surge in the penetration of smartphones and the Internet will open new avenues for the remittance industry in the upcoming era. Simultaneously, the equity management market is projected to witness transformation due to the rising trend of digitization and technological innovation.

Summing up

The AMR reports utilize scientific analytical tools such as Porter’s five forces to present a competitive landscape that helps companies expand their market presence and sustain the evolving domain. Industry leaders can achieve dominance by utilizing these research findings to understand market trends, identify growth opportunities, and develop strategies to capitalize on market expansion.

To gain insights into the regional analysis and investment opportunities of the BFSI domain, feel free to reach us!