Table Of Contents

Onkar Sumant

Koyel Ghosh

Transforming Wealth: Innovations, Challenges, and Success Stories in the Modern Financial Landscape

Wealth management encompasses a range of financial services aimed at assisting individuals in managing and growing their wealth. Wealth management firms, which range from large financial institutions to boutique advisory firms, play an important role in helping clients achieve their financial goals. These services include investment management, financial planning, tax services, retirement planning, and estate planning.

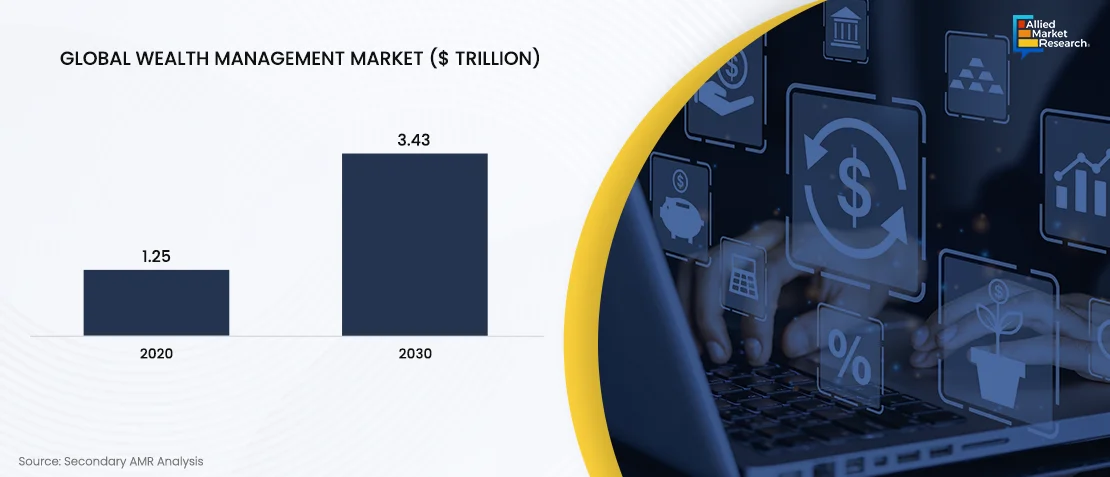

In recent years, the wealth management industry has experienced significant growth, driven by increasing global wealth, technological advancements, and changing client demographics. The market was valued at approximately $1.25 trillion in 2020 and is projected to continue growing at a steady pace.

One notable trend is the increasing adoption of digital technologies in wealth management. Firms are taking recourse to artificial intelligence, machine learning, and big data analytics to enhance their service offerings and improve client experience. For example, in November 2023, Era, an AI-powered wealth management platform, launched with a $3.1 million Seed round led by Northzone. Era aims to make wealth management accessible to all, using AI to provide personalized financial advice and automate tasks. The platform targets Gen Z and Millennials, offering tools to enhance financial literacy and management.

Another key trend is the growing importance of sustainable and impact investing. Investors are increasingly looking to align their investments with their values, seeking opportunities that deliver both financial returns and positive social or environmental impact. In January 2024, BlackRock, one of the world’s largest asset managers, announced that it had doubled its sustainable investment assets to around $800 billion from 2012, reflecting the rising demand for environmental, social, and governance (ESG) investment products.

The wealth management sector is also witnessing a demographic shift as younger generations, particularly millennials and Gen Z, become a more significant client base. These clients tend to prefer digital interactions and demand greater transparency and social responsibility from their wealth managers. This shift is driving firms to adapt their strategies and develop new, innovative solutions to attract and retain younger clients.

Exploring the Regulatory and Technological Challenges in Wealth Management

The landscape of wealth management, while promising, faces several challenges and constraints for businesses to remain competitive and effective. One of the primary challenges is the increasing regulatory burden. Regulatory bodies worldwide are imposing stringent compliance requirements to enhance transparency and protect investors. For example, in October 2023, the U.S. Securities and Exchange Commission (SEC) implemented new rules under the Investment Advisers Act, requiring wealth managers to disclose more detailed information about their fee structures and potential conflicts of interest. Again, in October 2023, the European Union introduced new regulations under the Sustainable Finance Disclosure Regulation (SFDR), which require wealth management firms to disclose how they integrate sustainability risks into their investment decision-making processes. These regulations, while beneficial for investor protection, increase the operational costs for firms and necessitate robust compliance infrastructures.

Another significant challenge is the rapidly changing technological landscape. While digital tools offer numerous advantages, they also require substantial investment in technology and cybersecurity. To protect against cyber threats, wealth management firms need to continuously update their systems. In May 2023, Mackenzie Investments, one of Canada’s largest investment firms, experienced a data breach affecting clients' Social Insurance Numbers (SINs), account numbers, names, and addresses due to a cyber security incident involving third-party vendor InvestorCOM Inc. The breach has raised concerns about identity theft and the use of SINs by third-party vendors. Mackenzie has apologized and offered credit monitoring services through TransUnion, although affected clients have faced long wait times for assistance.

The industry is also dealing with the challenge of meeting evolving client expectations. The rise of digital-native millennials and Gen Z clients has shifted the demand toward more personalized, transparent, and digital-first services. These clients expect seamless digital interactions and bespoke financial advice tailored to their unique needs and values. For instance, in April 2023, J.P. Morgan launched a new digital wealth management platform aimed at providing personalized investment advice through advanced analytics and AI. However, balancing the need for personalized service with the scalability of digital solutions remains a complex challenge for many firms.

Economic volatility and geopolitical uncertainties further constrain the wealth management market. Global events such as trade wars, political instability, and economic downturns can significantly impact market performance and client portfolios. The COVID-19 pandemic, for example, caused significant market fluctuations and forced wealth managers to reassess their strategies to mitigate risks and protect client assets. In January 2024, Wells Fargo and its Wealth and Investment Management division witnessed a 31% drop in profits to $491 million due to lower net interest income and declining deposit balances.

Lastly, talent acquisition and retention pose a considerable constraint. The industry requires highly skilled professionals with expertise in financial planning, investment management, and client relationship management. However, there is a growing talent shortage as experienced professionals retire and the demand for new skills takes a leap. Businesses should invest in training and development programs to attract and retain top talent.

While the wealth management market offers substantial growth opportunities, firms must address various challenges, including regulatory compliance, technological advancements, evolving client expectations, economic volatility, and talent management. Successfully addressing these constraints is essential for firms to thrive in this dynamic and competitive landscape.

Pioneering Progress: Harnessing AI, Blockchain, and Fintech Innovations in Wealth Management

The sector is evolving rapidly due to ongoing innovation and advancements in technology. These innovations are reshaping how wealth management services are delivered, enhancing client experiences, and improving operational efficiencies.

One of the most significant advancements in the sphere is the integration of artificial intelligence and machine learning. These technologies are being used to analyze vast amounts of data, providing more accurate and personalized investment recommendations. Financial institutions are set to double their AI spending to $97 billion by 2027, driven by the potential for AI to enhance asset protection and market predictions. JPMorgan Chase & Co. exemplifies this trend, with notable AI-related hiring and investments. However, the rapid adoption of AI also brings risks such as potential financial crises, cybercrime, and systemic risks due to reliance on past data. Central banks are cautiously exploring AI applications to improve supervision and efficiency while managing these emerging threats.

Blockchain technology is another remarkable innovation impacting the wealth management sector. Blockchain's ability to provide secure, transparent, and immutable transaction records is revolutionizing asset management, trading, and record-keeping processes. In June 2023, Fidelity Investments introduced a blockchain-based platform for asset management, aimed at improving transaction transparency and reducing settlement times. This platform is expected to streamline operations and provide clients with more secure and efficient services.

Digital platforms and robo-advisors are also gaining traction in the industry. These platforms leverage algorithms and digital interfaces to offer automated, low-cost investment advice and portfolio management. Vanguard's Personal Advisor Services, for example, combines robo-advisory services with human advisors to provide a hybrid model that offers both automation and personalized advice.

Sustainable and impact investing is another area where innovation is making a significant impact. Wealth management firms are developing new investment products that focus on ESG criteria. In January 2024, Morgan Stanley launched a suite of ESG-focused investment funds, responding to the increasing client demand for investments that align with their values. These products are designed to provide financial returns while promoting positive social and environmental outcomes.

Regulatory technology (RegTech) is also advancing, helping wealth management firms navigate complex regulatory landscapes more efficiently. RegTech solutions use AI and big data to automate compliance processes, reduce risks, and ensure adherence to regulatory requirements. In November 2023, HSBC implemented a new RegTech solution to enhance its compliance capabilities, streamline regulatory reporting, and reduce operational costs.

Finally, the rise of fintech collaborations is fostering innovation in the field of wealth management . Traditional wealth management firms are partnering with fintech companies to integrate cutting-edge technologies and enhance their service offerings. For example, in June 2023, Avaloq, a subsidiary of NEC Corporation, and BlackRock formed a strategic partnership, with BlackRock making a minority investment in Avaloq. This collaboration aims to enhance wealth management technology by integrating Avaloq’s core banking services with BlackRock’s Aladdin Wealth platform, improving portfolio management, client reporting, and risk analytics for wealth managers and private banks. The partnership targets clients in Europe and Asia, aiming to streamline operations and provide advanced technology solutions throughout the client journey.

These developments are enabling firms to deliver more personalized, efficient, and secure services, meeting the evolving needs of their clients and positioning themselves for future growth.

Case Study: Fujitsu's SaaS Solution for Wealth Management

Client Profile

A leading wealth management firm sought to modernize its IT infrastructure to enhance client service and operational efficiency. The firm managed substantial assets and needed a robust, scalable solution to support its growth.

Challenges

Legacy systems: The firm faced limitations with outdated IT systems, hindering its ability to provide seamless client services.

Operational inefficiencies: Manual processes and lack of integration across systems led to productivity losses and higher operational costs.

Regulatory compliance: Keeping up with evolving regulatory requirements was challenging with the existing infrastructure.

Solution

Fujitsu implemented a Software-as-a-Service (SaaS) solution tailored to the wealth management sector. Key components included:

Cloud-based platform: Transition to a cloud environment for scalable and flexible IT operations.

Integrated systems: Consolidation of disparate systems into a unified platform, enhancing data accessibility and management.

Enhanced security: Implementation of advanced security protocols to protect sensitive client data and ensure regulatory compliance.

Automated processes: Introduction of automation to reduce manual tasks, improving efficiency and accuracy.

Results

Improved client service: The new system enabled better client interaction and personalized services.

Operational efficiency: Automation and integrated systems significantly reduced operational costs and improved productivity.

Regulatory compliance: Enhanced compliance capabilities with real-time monitoring and reporting features.

Scalability: The cloud-based platform provided the scalability needed to support the firm’s growth ambitions.

Future Outlook and Strategic Recommendations

Businesses are witnessing substantial growth in wealth management, fueled by advancements in technology, shifts in client demographics, and a rising interest in sustainable investing. Firms should focus on utilizing AI and blockchain to enhance service delivery and operational efficiency. For example, integrating AI can personalize client experiences, as seen with Charles Schwab's AI-driven financial tool launched in February 2024. Additionally, firms must prioritize ESG investing, as evidenced by Morgan Stanley's launch of ESG funds in January 2024. To sustain growth and competitiveness in the evolving market landscape, embracing digital transformation and ensuring regulatory compliance are highly important.

Allied Market Research offers comprehensive analyses of the global wealth management market, focusing on key technological advancements, market dynamics, and regulatory landscapes shaping the industry. Our detailed reports provide stakeholders with crucial insights into the evolving role of wealth management in enhancing financial efficiency, client engagement, and regulatory compliance. Businesses can use these insights to identify new opportunities, drive innovation, and adopt more sustainable financial practices to improve market efficiency.

For an in-depth analysis of the growth drivers and investment opportunities in the wealth management industry, feel free to contact our experts!