Table Of Contents

Sonia Mutreja

Koyel Ghosh

The Success Story of the CONMA Industry in Q4 2024: Automation and Green Practices

In Q4 2024, the construction and manufacturing (CONMA) industry demonstrated resilience and innovation amid global challenges. Strong demand for infrastructure, residential, and commercial projects drove construction growth, while advancements in EV production and automation fueled manufacturing recovery. Regional efforts, supply chain stability measures, and sustainable practices were key contributors to this remarkable growth of the domain during the quarter.

Allied Market Research attempts to showcase notable trends that surged the growth of the CONMA industry in Q4 2024. It also highlights regional dynamics and the sector's adaptability in addressing skilled labor shortages, energy costs, and sustainability goals across diverse markets.

Prominent trends boosting CONMA sales during Q4 2024

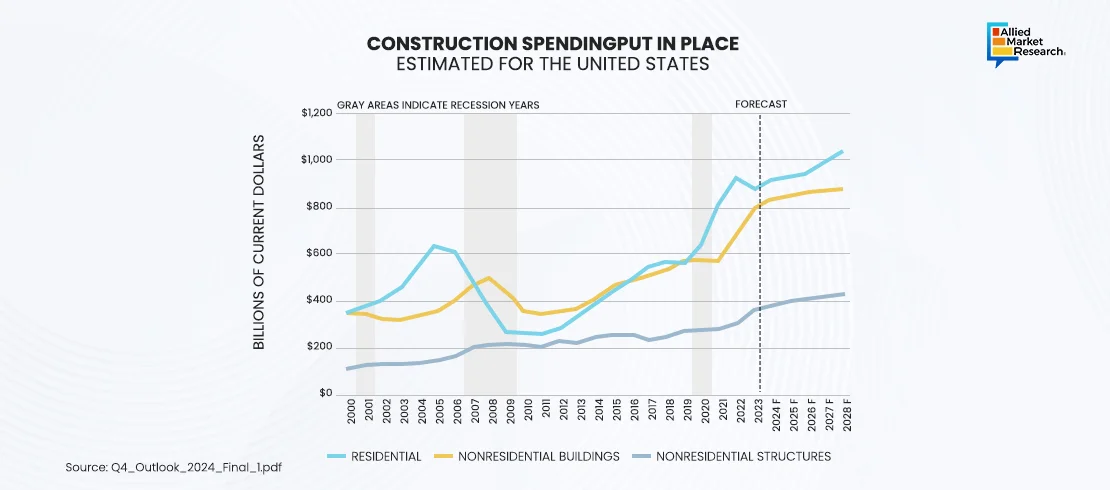

In Q4 2024, the construction sector observed significant growth in sales, driven by strong demand in residential, commercial, and infrastructure development. In the U.S., Bechtel expanded its infrastructure portfolio, focusing on projects like highways and airports, supported by government stimulus funds. Similarly, China State Construction Engineering Corp. (CSCEC) increased its residential projects in major cities, maintaining its dominance in the global construction market with impressive sales performance.

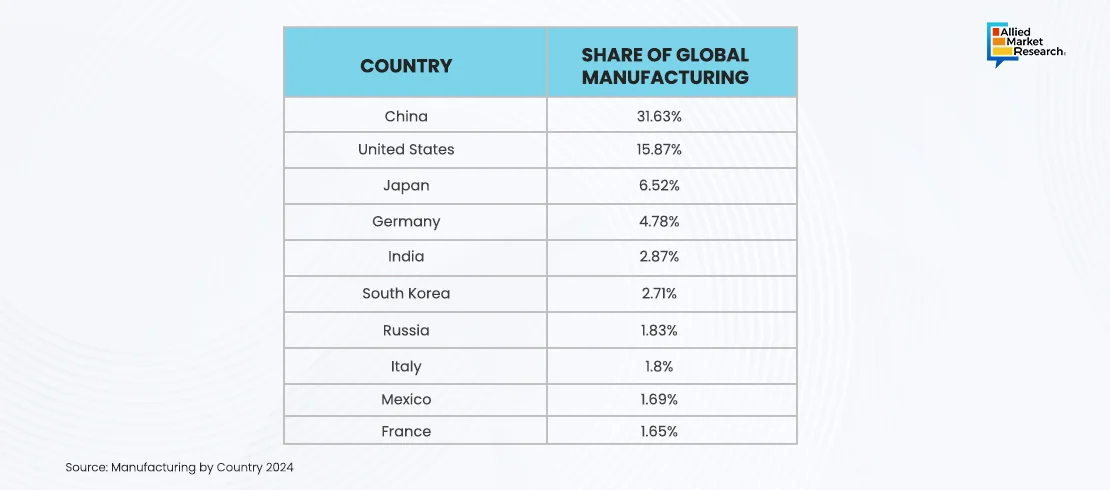

According to the above data, the manufacturing sector, with a focus on EVs and automation, also recovered steadily during the fourth quarter of 2024. General Motors, an American manufacturing company, reported a significant increase in EV output, driven primarily by the advancements of its Ultium battery platform. In addition, the trend toward factory automation gained huge recognition during the quarter. ABB’s strong sales in industrial robots showcased the industry’s transition toward automated solutions for enhanced productivity.

Regional highlights driving the industry’s growth in Q4 2024

The CONMA industry was evaluated worldwide during the fourth quarter of 2024. As per the above infographics, the North America region held the dominant share of the global industry due to the rise in the demand for residential and commercial buildings. In the U.S., Lennar, a home construction company, thrived due to high demand for suburban homes and ongoing residential construction. AECOM, an American infrastructure consulting firm benefited from significant infrastructure projects, including public transportation networks in New York and Los Angeles. Additionally, Tesla's new Gigafactory in Texas boosted local manufacturing, especially in the EV sector, and helped drive economic growth.

On the other hand, Europe's construction sector experienced a notable recovery, driven by increased government investments in infrastructure and green buildings. Skanska, a prominent Swedish firm, secured contracts for sustainable projects, focusing on energy-efficient structures. In manufacturing, Volkswagen faced challenges from high energy costs in Germany, but it responded strongly in the quarter by investing in renewable energy sources to power its factories and implemented more energy-efficient production processes. This signified the bold step of the firm toward sustainability amid rising operational costs.

Moreover, the construction sector in the Asia-Pacific region also thrived during quarter. This is mainly due to the heavy investments made by the China National Petroleum Corporation (CNPC) in energy infrastructure projects. In India, Larsen & Toubro, a high-tech manufacturing company experienced significant growth in civil infrastructure projects due to government initiatives aimed at economic development. Meanwhile, in manufacturing, Samsung Electronics increased semiconductor production to meet global demand, especially in South Korea, while Toyota expanded its automotive manufacturing capabilities in India and Thailand.

Simultaneously, in the Middle East, the demand for large-scale construction projects along with Saudi Aramco’s significant funding initiatives like the Neom city development drove the regional growth significantly. Meanwhile, in Africa, Dangote Group led manufacturing advancements, particularly in cement production, to support ongoing infrastructure development across the continent. These efforts highlighted a bold step toward enhancing economic stability and growth in both regions.

Innovative approaches to bring supply chain stability in the CONMA sector in Q4 2024

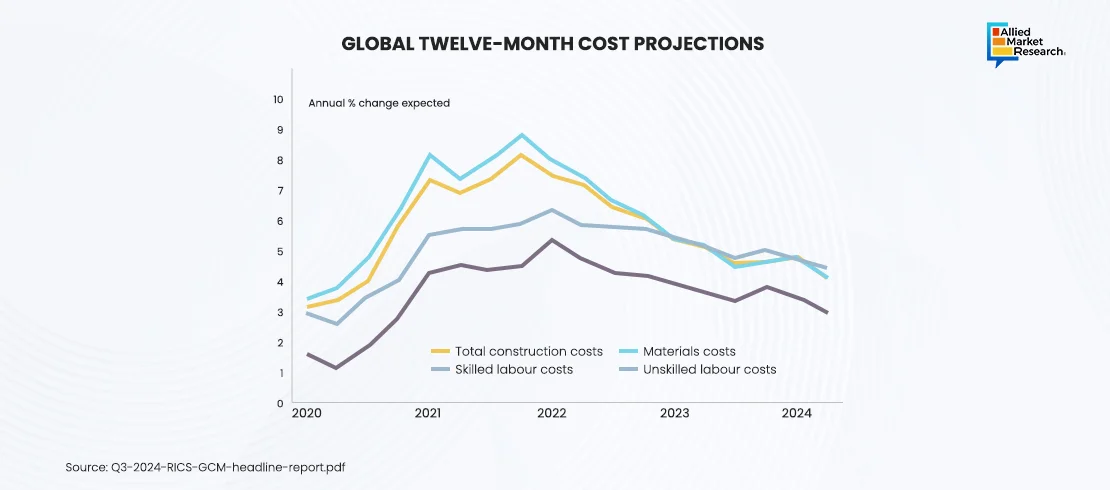

In Q4 2024, supply chain disruptions persisted in the construction industry, particularly with delays and price increases for materials like steel, timber, and cement. LafargeHolcim, a leading building materials company, proactively addressed these challenges by enhancing local sourcing strategies in the U.S. The firm established new partnerships with regional suppliers in Texas and Georgia to ensure a steady supply of aggregates and cement. This further reduced reliance on volatile international shipping and minimized transportation costs and delivery times.

Similarly, Vulcan Materials Company, a key supplier of construction aggregates in the U.S., enhanced its operations by investing in digital supply chain technologies. These innovations allowed the company to monitor inventory levels and streamline logistics effectively. With predictive analytics tools, Vulcan anticipated shortages and rerouted supplies from overstocked regions to areas with high demand, ensuring timely deliveries to construction sites.

In addition, Weyerhaeuser, a North American timber supplier, adopted a direct-to-contractor model that bypasses traditional distribution channels. This strategy reduced lead times and enhanced pricing competitiveness. It further helped alleviate delays caused by international timber shortages, particularly those resulting from Canadian export restrictions.

On the other hand, the global semiconductor shortage affected the manufacturing sector in Q4 2024, impacting various industries from automotive to consumer electronics. To deal with the issue, Ford Motor Company expanded its partnership with GlobalFoundries, focusing on co-developing custom chips for Ford's electric vehicles and advanced driver-assistance systems. This collaboration aimed to secure a dedicated supply of critical components, helping to alleviate potential hurdles in semiconductor production.

Moreover, In Japan, Toyota significantly boosted investments in local chip manufacturers like Renesas Electronics Corporation while diversifying its supplier base to include partners in South Korea and the U.S. This multi-sourcing strategy minimized risks associated with disruptions in any single region, ensuring production continuity during global shortages, particularly through its partnership with ON Semiconductor in the U.S.

Furthermore, Apple, another key player in manufacturing, shifted some of its production to Vietnam and India to lessen its dependence on China, which faced production slowdowns due to energy crises and geopolitical tensions. In India, suppliers like Foxconn ramped up assembly lines for flagship products, including the iPhone and MacBook.

Bosch, a leading supplier of automotive and industrial technology, opened a state-of-the-art semiconductor production plant in Dresden, Germany. This facility, powered by artificial intelligence, ensured Bosch’s supply chain remained robust while supporting European manufacturing independence in the semiconductor market.

Key challenges and solutions in the CONMA industry in Q4 2024

As per the above graph, in the fourth quarter of 2024, the construction industry struggled with significant skilled labor shortages, leading to project delays. To address this issue, Turner Construction invested in digital technologies like 3D printing and drones, reducing the need for manual labor and accelerating construction timelines. Additionally, Turner collaborated with trade schools to establish training programs, ensuring a future pipeline of skilled workers.

Moreover, several manufacturing companies in Europe faced challenges due to soaring energy costs, which significantly affected their operations. Siemens, a German multinational technology firm, addressed this challenge by implementing smart energy management systems in its factories to optimize energy usage and minimize waste. Meanwhile, Volkswagen invested heavily in solar panels and wind energy for its German plants, reducing reliance on fossil fuels and mitigating the effects of rising energy prices.

In parallel, both construction and manufacturing sectors were under pressure during the quarter to reduce their carbon footprint due to the increased focus on sustainability. Skanska, a multinational construction and development company, led the way in sustainable construction by initiating projects like the Stockholm Waterfront Hotel. This project exemplified its step toward zero carbon emissions across the sites by utilizing green building materials and energy-efficient designs. Similarly, General Electric focused on sustainable manufacturing by transitioning to renewable energy sources in its production facilities, effectively reducing emissions and energy consumption while promoting environmental responsibility.

Winding up

In Q4 2024, the CONMA industry observed significant growth by addressing global challenges through innovation, sustainability, and regional collaborations. With advancements in automation, supply chain stability, and green practices, the sector stood out firmly for sustainable growth during the quarter. This ensured long-term economic and environmental progress across various markets in the landscape.

To gain key insights into the strategies adopted by top players in the CONMA industry, feel free to contact our esteemed analysts here!