Table Of Contents

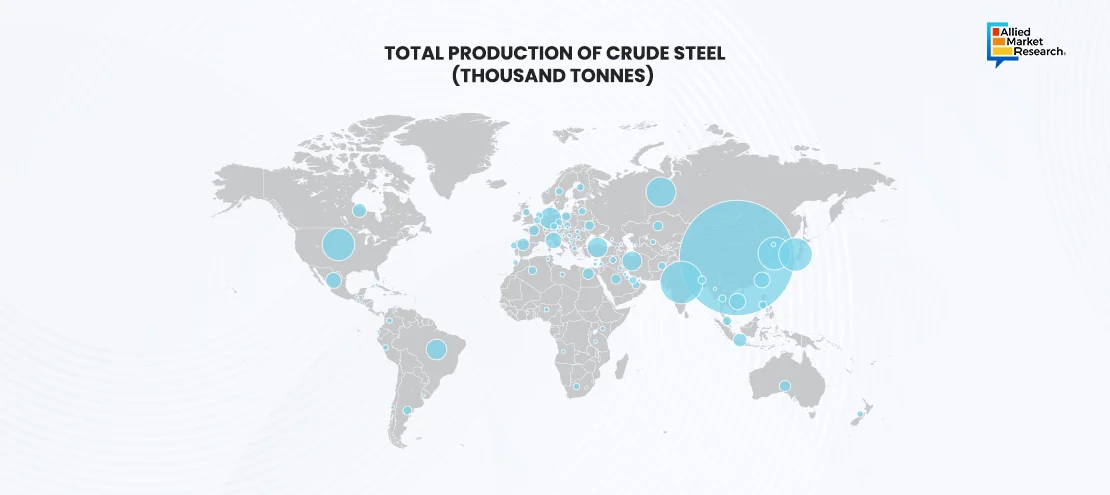

- Total Production of Crude Steel of Top 10 Countries in 2023 (Thousand Tonnes)

- Economic and Social Impact of the Steel Industry

- Supply Side Analysis

- Value Chain Analysis

- Technological Advancements in Structural Steel

- Sustainability and Environmental Impact

- Case Studies

- Shanghai Tower Project: The Shanghai Tower, the tallest building in China, used over 180,000 tons of high-performance structural steel supplied by Baosteel in its construction. The tower, completed in 2022, used Baosteel’s seismic-resistant steel, which is designed to withstand earthquakes. The high-quality steel reduced material usage by 12% and contributed to the building’s LEED Platinum certification due to its eco-friendly construction methods. Built with structural steel, the tower is both strong and eco-friendly, making it a symbol of sustainable city growth.

- Crossrail Project: The Crossrail project in London, Europe’s largest infrastructure project, utilized over 150,000 tons of structural steel, primarily supplied by Tata Steel, for the construction of tunnels, stations, and bridges. Tata’s high-strength steel was chosen for its durability and ability to support heavy loads. By using steel with a reduced carbon footprint, the project achieved a 20% reduction in greenhouse gas emissions compared to conventional methods. Structural steel plays an important role in large-scale infrastructure, and this project highlights both its importance and the industry's dedication to sustainability.

- The Latest Breakthroughs in Structural Steel

- Summing up

Sonia Mutreja

Koyel Ghosh

Optimizing Structural Steel Market: Key Considerations for Businesses

Structural steel plays a key role in the construction industry due to its strength, versatility, and sustainability. Structural steel is essential to modern architecture and infrastructure, serving as the core of everything from skyscrapers to bridges. Structural steel, a major product of crude steel, which reached 1.9 billion tons in global production in 2023, benefits from advances in steelmaking technology and the growing focus on energy-efficient processes. The conversion from crude to structural steel involves refining and shaping steel to meet specific construction demands, ensuring high tensile strength, durability, and adaptability. This seamless link between crude steel production and the structural steel market fuels its growth, with increasing demand from infrastructure development and urbanization projects across the globe.

The global structural steel market size was valued at $106.4 billion in 2022, and is projected to reach $177.4 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032.

Total Production of Crude Steel of Top 10 Countries in 2023 (Thousand Tonnes)

Economic and Social Impact of the Steel Industry

Steel is a key driver of modern infrastructure and manufacturing, enabling innovation across multiple industries. Given its vast applications, measuring its full economic impact is challenging. To get a clear picture, worldsteel hired independent experts to study the industry's global influence. The key findings are summarized in the infographic below.

Supply Side Analysis

The structural steel industry supply chain has witnessed significant changes, particularly in manufacturing efficiency and material availability. Major players like ArcelorMittal and Nippon Steel Corporation have been scaling production through innovations in steel-making processes. For example, ArcelorMittal reported a 15% increase in structural steel production in 2021 by integrating electric arc furnace technology, which consumes 30% less energy than traditional blast furnaces. This transition has led to a 20% reduction in carbon emissions, supporting global sustainability efforts.

The rise of high-strength, low-alloy (HSLA) steel has contributed to overall industry growth, with companies like Tata Steel introducing stronger, lighter steel grades in 2022, resulting in a 10% reduction in material costs for large construction projects. These new grades have been particularly favored in the construction of high-rise buildings due to their superior load-bearing capacity.

On the distribution front, suppliers have expanded logistics networks to meet rising global demand. In 2021, Steel Dynamics opened a new mill in Texas, increasing domestic supply in the U.S. and reducing import reliance by 18%. Additionally, steel manufacturers have adopted just-in-time inventory management practices, improving delivery times by 22%, ensuring timely project completion, and reducing stockpiling costs.

However, there are certain challenges too. Steel production costs have risen due to a 10% increase in iron ore prices and a 15% surge in energy costs in 2023. To mitigate these challenges, manufacturers are turning to alternative raw materials like scrap metal, which now makes up 25% of the total steel input in leading mills, reducing costs while promoting sustainability.

Value Chain Analysis

The structural steel value chain begins with the extraction of raw materials, including iron ore and coal, followed by processing into steel beams, bars, and plates. Companies like BHP and Rio Tinto are key suppliers of raw materials, providing high-quality iron ore used in the production of structural steel.

At the manufacturing stage, firms like Nucor and Gerdau produce various structural steel products, including I-beams, H-beams, and steel plates, which are important for constructing buildings, bridges, and industrial structures. In 2023, Nucor introduced its new ultra-high-strength steel, which reduces material usage by 15% while maintaining structural integrity, helping reduce overall project costs.

The distribution stage ensures finished steel products reach contractors and construction firms through a network of suppliers and retailers. Investments in digital supply chain platforms have enabled real-time inventory tracking, allowing contractors to place orders seamlessly. This advancement has cut order lead times by 25% and improved efficiency for project managers.

In the final stage, structural steel is assembled into frameworks for buildings and infrastructure projects. For instance, in 2022, the Hudson Yards development in New York City used over 120,000 tons of structural steel, sourced from U.S. Steel and fabricated by Schuff Steel, to build the foundations and frameworks of its skyscrapers. The success of the project relied heavily on the accurate fabrication and timely delivery of steel components.

Technological Advancements in Structural Steel

Technological innovations are transforming the structural steel market. The integration of Building Information Modeling (BIM) in 2022 by companies like Trimble has revolutionized project planning, with 3D models helping engineers accurately design steel structures. This has led to a 15% reduction in construction errors and a 10% increase in project completion speed.

In addition, the development of corrosion-resistant steel coatings by JFE Steel in 2023 has enhanced the durability of steel structures in coastal and industrial environments. These coatings, which extend the lifespan of steel by 25%, have been widely adopted in bridge and marine construction. For example, the new San Francisco Bay Bridge utilized over 50,000 tons of this coated steel, ensuring a longer life span and reduced maintenance costs.

Sustainability and Environmental Impact

The structural steel market is moving toward greener solutions. A 2023 report from the World Steel Association showed that the use of recycled steel in construction projects reduces carbon emissions by 58%. One Vanderbilt, a 1,401-foot skyscraper in New York City, showcases this trend by incorporating 80% recycled steel in its construction, which helped cut carbon emissions by 25% for the project.

Furthermore, energy-efficient production methods, such as using electric arc furnaces (EAFs), are becoming more common. In 2022, EVRAZ North America implemented a closed-loop water recycling system in its Pueblo, Colorado plant, which reduced water usage by 30% and lowered overall energy consumption by 12%, making it one of the greenest steel mills in North America.

Case Studies

Shanghai Tower Project: The Shanghai Tower, the tallest building in China, used over 180,000 tons of high-performance structural steel supplied by Baosteel in its construction. The tower, completed in 2022, used Baosteel’s seismic-resistant steel, which is designed to withstand earthquakes. The high-quality steel reduced material usage by 12% and contributed to the building’s LEED Platinum certification due to its eco-friendly construction methods. Built with structural steel, the tower is both strong and eco-friendly, making it a symbol of sustainable city growth.

Crossrail Project: The Crossrail project in London, Europe’s largest infrastructure project, utilized over 150,000 tons of structural steel, primarily supplied by Tata Steel, for the construction of tunnels, stations, and bridges. Tata’s high-strength steel was chosen for its durability and ability to support heavy loads. By using steel with a reduced carbon footprint, the project achieved a 20% reduction in greenhouse gas emissions compared to conventional methods. Structural steel plays an important role in large-scale infrastructure, and this project highlights both its importance and the industry's dedication to sustainability.

The Latest Breakthroughs in Structural Steel

In 2023, researchers at MIT developed a new form of steel alloy that is 25% lighter than traditional steel but retains the same strength. This breakthrough comes with the potential to revolutionize high-rise construction by reducing material usage and overall building weight, leading to lower construction costs. Additionally, steel manufacturers are exploring the use of hydrogen in steelmaking, which could reduce carbon emissions by 90%. ArcelorMittal, for example, is currently testing hydrogen-based steel production at its Hamburg facility, with plans to scale this technology by 2030.

Another innovation is the use of modular steel structures, which allow for faster construction times. In 2022, Z Modular completed a 10-story office building in just six months using prefabricated steel modules, a 50%-time reduction compared to traditional construction methods. This approach is gaining popularity in urban areas where quick project completion is essential.

Summing up

The structural steel industry is growing steadily, driven by new technology, sustainability efforts, and the need for strong materials. Companies that use smart manufacturing, automation, and eco-friendly methods are expected to stay ahead in the market. Structural steel is a key part of modern buildings and infrastructure, playing a major role in construction worldwide. As cities grow and industries are expanding, the demand for strong and sustainable materials is projected to keep rising. With continuous improvements and innovation, the industry is anticipated to support the future of construction and development on a global scale.

Allied Market Research delivers essential insights and strategies for businesses in the structural steel market. These insights help companies stay competitive, improve product performance, and meet the demands of an evolving construction landscape.

For more detailed insights into landscape, contact our specialists today!