Dairy Products: A Leap Toward Clean Label and Sustainable Choices

Dairy is a mainstay of the global food chain as well as a vital source of nutrients for billions of people worldwide. Dairy products, such as butter, yogurt, and cheese, are used as primary ingredients in many recipes and are also savored independently. Changing consumer demands and preferences are shaping the dairy products industry. For instance, surge in environmental concerns and increase in health consciousness coupled with inclination toward clean label food are indicative of the industry’s evolving dynamics. In addition, an alarming increase in the prevalence of lactose intolerance is encouraging consumers to opt for lactose-free dairy products enriched with probiotics.

According to a study published by the National Center for Biotechnology Information—a branch of the National Institutes of Health, U.S.—around 65% of the global population suffers from lactose intolerance. Thus, as consumers place a higher priority on their well-being, there is a growing demand for dairy products that are functional and enhanced with probiotics, vitamins, and minerals. These dairy products appeal to an increasing number of health-conscious consumers by providing advantages like increased immunity, easier digestion, and improved gut health.

Low Sugar, Sustainability, and Clean Label—Taking Center Stage

The perspective of life has changed drastically over the years, with a major emphasis on well-being and sustainability. Although consumers are conscious about the sugar intake, they are unwilling to compromise on the taste and texture. Thus, to attract a large consumer base, ice cream brands are introducing unique flavor combinations, which are low in sugar and high in fiber. This has further encouraged manufacturers to develop taste modulation solutions to cater to savory and wellness requirements. This is primarily attributed to the fact that no sugar alternatives can match the taste exhibited by sugar itself; hence, modulating the taste of high intensity sweeteners is the only viable option.

Corinna Faustmann, R&D Category Leader Dairy & Dairy alternatives at Cargill Holding (Germany) GmbH, thoughtfully said “Manufacturers should not only focus on creating great and indulgent dairy products but also use responsibly sourced ingredients.” For instance, Givaudan—a developer of delightful taste and scents—offers the only known clean label, naturally sweet protein that is commercially available, thaumatin. Thaumatin is extracted using a proprietary process to produce Talin®, which is a purified grade flavor modifier. Talin® is used at extremely low concentration in food & beverages in combination with natural sweetener, stevia to help modify the flavor profile. Thus, as sugar reduction remains a key aspect among consumers, developing the right sweet taste is the only way to engage them.

Sustainable Dairy Farming: Moving Toward Tomorrow

Sustainable dairy farming depends on effective water management, especially in areas where water is scarce. Strategies such as drip irrigation, rainwater collection, and precision irrigation systems have been adopted to maximize water utilization and decrease water wastage. Water conservation measures can be further improved by recycling and reusing water. In addition, governments have been taking the initiative to use recycled water for irrigation and cleaning in dairy operations. For instance, Dairy Cares, a non-profit organization that aims to ensure the long-term sustainability of California's dairy farming families, claims that recycling nutrients significantly helps in water conservation. California diaries use approximately 40% of feed ingredients, which are agricultural byproducts such as hulls, citrus pulp, and cotton seeds that might otherwise go unused. Dairy farms are focusing on upcycling these products, thereby minimizing the use of energy, fossil fuels, and water required for growing and harvesting feed crops. Research conducted at University of California, Davis in 2020 revealed that the practice of upscaling agricultural byproducts reduces the amount of water usage—required to grow feed crops—by around 1.3 trillion gallons. In addition, dairy farmers are responding equally to such initiatives by adopting water-smart management practices, including conservation and reuse, thereby reducing their water footprint. These measures collectively have reduced the water usage required to produce each gallon of milk in California by more than 88% over the last 50-plus years.

Furthermore, with increasing use of renewable energy sources in dairy farming operations, energy efficiency can be improved, and greenhouse gas emissions can be decreased considerably. Dairy farms are increasingly utilizing renewable energy sources like solar panels, wind turbines, and biogas systems. For example, Fair Oaks Farms in Indiana has put in place a comprehensive system of renewable energy that includes anaerobic digesters that turn manure into biogas, which powers the farm and lowers its carbon footprint.

Thus, maintaining long-term sustainability of the dairy sector requires a balance between social responsibility, environmental stewardship, and economic competitiveness.

Evaluating the Pace of Progress

Global dairy production is a multibillion-dollar business that is essential to the economies of many nations. According to the Food and Agriculture Organization (FAO) of the United Nations, as compared to the 0.6% growth seen in 2022, the global milk production in 2023 increased to 950 million tons, an increase of 1.3% annually. This growth was primarily attributed to volume growth in Asia, specifically in China and India, with moderate growth in the rest of the world and possibly lower production in Africa.

Predictions indicate that Asia's dairy industry will continue to grow considerably, driven by rising demand and advancements in farming techniques. As a result, Asia's influence in the global dairy sector is expected to increase substantially in the future.

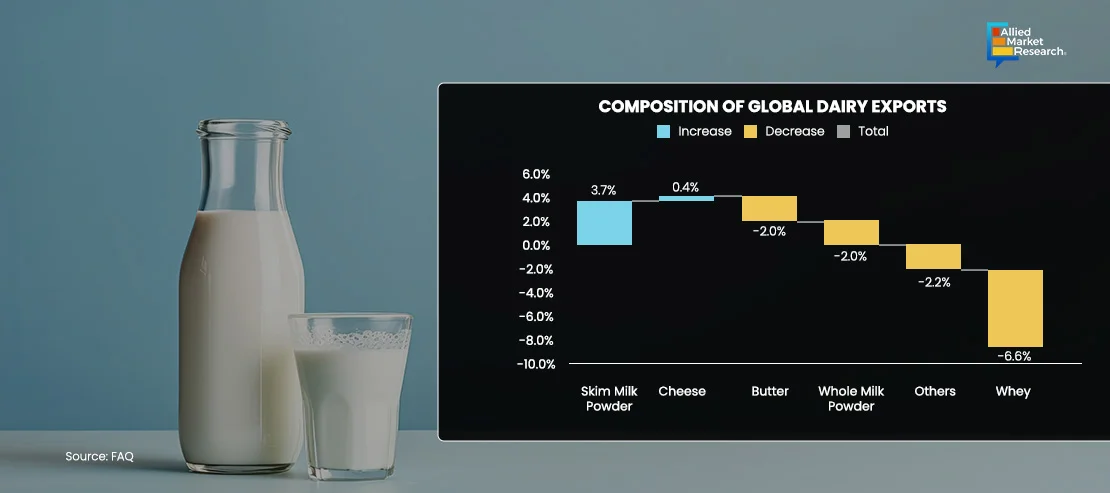

FAO further stated that the exports of cheese and skim milk powder surged by 0.4 and 3.7%, respectively, in 2023. However, whey powder saw the biggest decline in the trade of dairy products in 2023 (measured in milk equivalents), presumably falling by 6.6%. In addition, whole milk powder and butter were the second biggest decliners, falling by 2.0% each.

Global butter exports reached a record high of 1.1 million tons in 2022 but then declined by 2.0% annually in 2023. Export volumes were higher in 2023 than those of 2020 and 2021 despite this projected decline. Trade declines reflect expected declines in imports from the Philippines, China, Indonesia, Bahrain, and other countries.

Global cheese exports reached 3.5 million tons in 2023, up by 0.4% on account of increased imports from China, the U.S., the UK, Australia, the Russian Federation, Saudi Arabia, and Mexico.

Global skim milk powder exports recovered, increasing by 3.7% to 2.7 million tons, majorly due to strong import demand in China, Mexico, Vietnam, Algeria, and the Philippines, but also possibly being offset by declines in Indonesia, Egypt, Nigeria, and Malaysia.

Global whole milk powder exports reached 2.4 million tons in 2023, down by 2.0% from the previous year. This is a fall for the second consecutive year, though that is far less severe than the 12% decline in 2022. The world's top whole milk powder importer, China, together with Bangladesh, Vietnam, and Thailand, has the slowest import demand, which is largely responsible for the ongoing downturn in the whole milk powder trade. These reductions will probably be somewhat compensated by growth or recoveries in imports from importing nations, particularly Brazil, Sri Lanka, Algeria, and Iraq.

Shedding Light on Key Trends Shaping the Dairy Industry

Technological developments have notably contributed to the dairy industry's transformation. Innovations are increasing productivity, ensuring food safety, and boosting product quality from farm to table. For insurance, automated milking systems is one such technology that has transformed dairy production by lowering labor costs and enhancing productivity. These systems are integrated with sensors and data analytics, which aid to track the productivity and well-being of cows to ensure the best possible milk yield. Blockchain in agriculture and food industry is gaining high prominence, in addition to automation, as it enhances food safety and mitigates the risk of frauds by enabling transparency and traceability. Nestlé and Carrefour, for instance, have teamed together to use blockchain technology to track the origins of their milk products, giving customers comprehensive details on the product's path from farm to shelf.

Moreover, the types of dairy products that are in demand are impacted by consumer preferences, which are shifting more in favor of well-being. The use of probiotics, vitamins, and minerals to enhance dairy products is becoming more common. One such product that is marketed for its benefits to digestive health is yogurt, which contains probiotics. Health-conscious consumers have been drawn in by brands like Yakult and Activia, which have effectively advertised their products using these health claims. Organic, low-fat, and low-sugar dairy products are also becoming more popular. By limiting the use synthetic fertilizers and pesticides, organic dairy production is gaining high popularity. Supermarkets are now frequently carrying organic milk, cheese, and yogurt, appealing to customers who are prepared to spend more on products they believe to be healthier and more ethical.

Bypassing the Barriers

The dairy industry faces a myriad of challenges that require innovative solutions and collaborative efforts from stakeholders across the value chain.

A major issue with dairy farming is its influence on the environment. Methane from enteric fermentation and manure management releases greenhouse gases in dairy farms. The Food and Agriculture Organization (FAO) estimates that the dairy industry is responsible for 4% of greenhouse gas emissions worldwide. Dairy production also results in water pollution due to runoff and overuse. Improvements in feed efficiency to lower methane emissions, improved manure management techniques, and the adoption of precision agriculture technologies to maximize resource utilization are some of the steps taken to reduce these environmental effects. For instance, it has been demonstrated that adding seaweed to the diet can lower methane emissions from cows.

Furthermore, concerns over the well-being of dairy cows, such as their access to pasture, housing circumstances, and humane handling techniques, are growing among consumers. For dairy cows to remain healthy, they must have access to a balanced diet, hygienic housing, and routine veterinarian medical care. Enhancing animal welfare involves actions like implementing pasture-based systems, handling animals with compassion, and offering enrichment activities. Products that satisfy high welfare standards can be easily identified by consumers with the use of certification programs and labels like Animal Welfare Approved and Certified Humane. For instance, Organic Valley, a cooperative of organic farmers, complies with stringent regulations for animal welfare, guaranteeing that their dairy cows are housed in humane conditions and have access to pasture.

Plant-based substitutes such as almond, soy, oat, and coconut milk are gaining high traction in the market due to alarming increase in health concerns, shifting nutritional preferences, and rising environmental awareness. As per a report published by the Good Food Institute, a 501 nonprofit organization that promotes plant- and cell-based alternatives to animal products, in 2022, the plant-based milk industry expanded by 20%, with the U.S. alone accounting for $2.5 billion of its total worth. Plant-based substitutes are becoming more popular than dairy products. There are also notable advancements being made in plant-based ice cream, cheese, and yogurt.

Summing up

Global developments, customer preferences, and environmental requirements have transformed the dairy sector, making it a dynamic and diverse industry. Although the industry is witnessing rapid innovations in terms of low-sugar, sustainability, and clean label dairy products, it faces challenges such as market volatility, climate change, and competition from alternative products. However, the dairy business can overcome obstacles and prosper in a market that is changing quickly by embracing technological developments, broadening its product offerings, and placing a high priority on sustainability.

Allied Market Research emphasizes the sustainable practices and contributions made by the dairy industry as well as farmers for a healthier and more environmentally friendly future. AMR’s commitment to provide comprehensive market insights, trends, and forecasts enables vendors to make informed decisions that drive growth and success. Through tailored reports, custom consulting services, and ongoing support, AMR equips vendors with the knowledge and tools needed to capitalize on the inherent advantages of clean label dairy products. Whether identifying emerging trends, evaluating market entry strategies, or optimizing product portfolios, our team of experts provides actionable insights to help your business reach its goal.

For more details, contact our esteemed professionals today!