Table Of Contents

- Transition toward chiplet architecture, semiconductor sustainability, and AI integration helping the sector flourish

- Investments in semiconductor fabrication and focus on supply chain resilience impacting the industry positively

- Technological advancements and innovations reshaping the semiconductor and electronics domain

- M&A deals, partnerships, and product launches by major players boosting the market value of the domain

- The final word

Sonia Mutreja

Koyel Ghosh

Semiconductor and Electronics Sector: Key Strategies, Innovations, and Trends Shaping 2025

Over the years, the semiconductors and electronics domain has become one of the largest sectors in the global economy. The increasing penetration of different digital technologies has led to a surge in demand for advanced integrated circuits and chipsets. Furthermore, the expansion of the consumer electronics landscape has increased the focus on manufacturing of different semiconductor devices and components, thus accelerating the domain’s growth and success. Furthermore, multinational companies have been actively investing their capital to expand their production facilities and ramp up their manufacturing capabilities in the coming period. Along with this, many other administrative, geopolitical, and socioeconomic factors have influenced the semiconductor and electronics sector in the last few years. This newsletter explores all such aspects of the landscape and provides an in-depth analysis of the major trends, strategies, and innovations that are expected to drive the domain in 2025.

Transition toward chiplet architecture, semiconductor sustainability, and AI integration helping the sector flourish

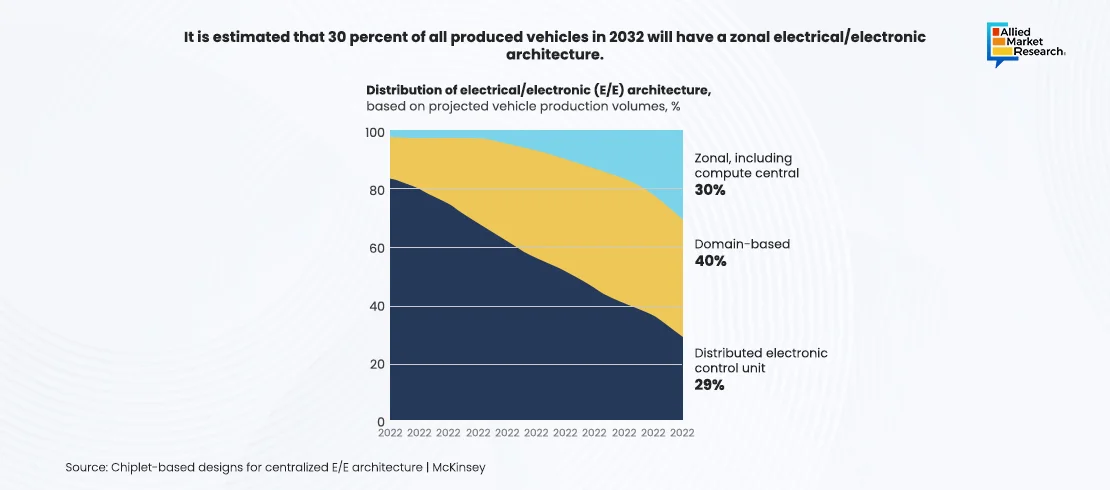

A chiplet is an integrated circuit that is combined to create an intricate and complete system-on-chip (SoC). The development of advanced digital devices and gadgets has led to an increase in demand for high-performance chiplet architecture which aids in reducing latency and power consumption. Furthermore, compared to monolithic chip frameworks, this new technology offers much higher output in manufacturing. At the same time, electronics companies are focusing on the development of semiconductors that have minimal environmental impact. Along with this, businesses are increasingly adopting renewable energy sources to power their operations, thereby reducing their carbon footprint in the long run. Moreover, the use of green practices, energy-efficient fabrication processes, and water recycling activities is anticipated to bring numerous growth opportunities to the sector in 2025.

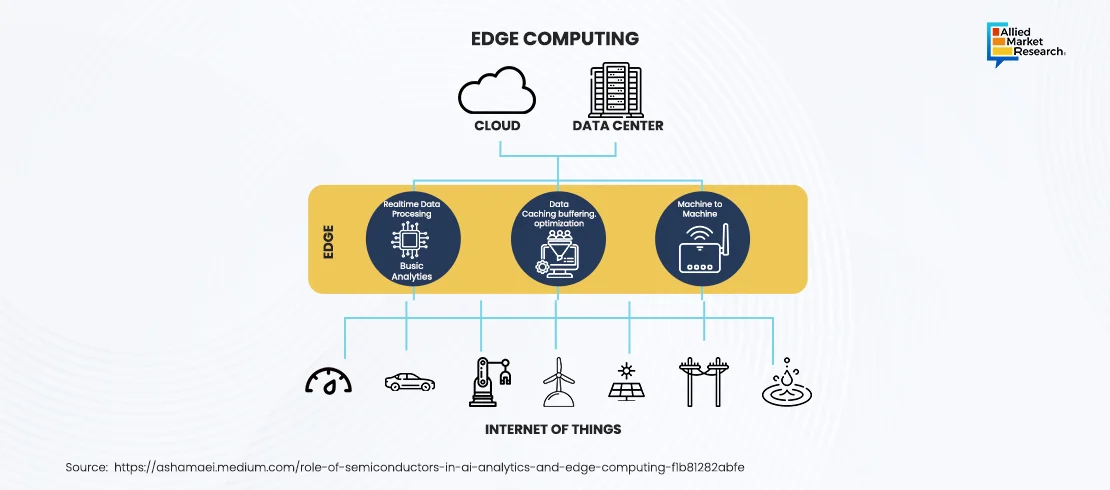

The rising integration of AI-powered semiconductor chips in modern electronic devices has completely revolutionized the landscape in the past few years. Furthermore, companies are focusing on developing graphics processing units, neuromorphic processors, and tensor processing to address the evolving demands of the sector. On the other hand, the demand and applicability of edge computing have increased significantly with several end-use industries to improve the speed, reliability, efficiency, security, and scalability of their operations. Thus, the rising utility of this novel computational technology is expected to create favorable conditions for the expansion of the domain throughout 2025.

Investments in semiconductor fabrication and focus on supply chain resilience impacting the industry positively

Over the years, almost all major electronics companies such as Samsung, TSMC, and Intel have invested heavily in semiconductor fabrication technologies to increase their footprint across the domain. As part of their expansion strategy, these players have announced their plans to establish new fabs in various countries, including Japan, the US, and Europe. TSMC, for example, has set up a new fabrication facility in Arizona which is projected to start developing 3nm chips in 2025. Along with this, businesses are also using AI-based tools and machine learning algorithms for process optimization and predictive maintenance functionalities. Moreover, AI has proven to be extremely beneficial in raw material procurement, chip development, and inspection activities.

Along with this, businesses have started focusing on diversifying their supply chains to avoid any future disruptions in their operations. The emphasis on improving the resilience of their logistics has led to enterprises opting for local vendors, thereby reducing their dependence on just one supplier or region. Additionally, companies are collaborating to invest in R&D activities for designing state-of-the-art semiconductor chipsets. Governmental initiatives such as the CHIPS Act in the U.S. are anticipated to promote the growth of the semiconductor fabrication industry in 2025.

Technological advancements and innovations reshaping the semiconductor and electronics domain

Along with the integration of AI in semiconductor manufacturing, innovations in the field of material sciences have played an important role in the expansion of the sector. In the last few years, the development of compounds such as silicon carbide (SiC) and gallium nitride (GaN) has opened new avenues for growth in the industry. Chemical engineering studies have shown that these materials offer much higher efficiency and productivity as compared to conventional silicon-based semiconductors. As a result, these compounds are widely used in various applications, including 5G base stations, EV chargers, solar inverters, etc. The rising popularity of SiC and GaN-based ICs is estimated to create lucrative opportunities in the sector.

On the other hand, the advent of quantum computing chips is one of the most exciting developments in the semiconductor and electronics domain. Multinational technology giants such as Google, Intel, IBM, etc., have recently announced their plans to design advanced ICs that have the capabilities to support quantum computing and other such high-performance applications. Developed using superconducting materials, these chipsets are now increasingly being deployed by companies for powering cryptography solutions and systems. In addition, the rising use of quantum computing chips in the pharmaceutical industry is predicted to maximize the revenue share of the sector in 2025.

M&A deals, partnerships, and product launches by major players boosting the market value of the domain

Recently, several companies have announced their plans to establish strategic alliances with their peers to gain a competitive advantage in the industry. For example, in January 2025, Adisyn, an end-to-end cybersecurity services provider and data center operator, reported in its press release that it had signed an agreement to acquire 2D Generation, an Israeli semiconductor company. The acquisition will help Adisyn to develop next-generation chips using 2D Generation’s pioneering graphene coating technology. On the other hand, Macom Technology Solutions, an American technology enterprise, has declared that it will be partnering with the federal government to establish plants in North Carolina and Massachusetts. The press statement given by Macom Technology Solutions highlighted that the company would invest $345 million in the coming period to complete this project.

Apart from the M&A deals and collaborations, certain players have launched innovative products and services to cater to the demands of their consumer base comprehensively. For example, in January 2025, NVIDIA, a world leader in artificial intelligence computing, announced the release of foundation models running locally on NVIDIA RTX™ AI PCs. Designed specifically to supercharge digital humans, these solutions are powered by GeForce RTX™ 50 Series GPUs which possess the capacity to perform 3,352 trillion operations per second. Similarly, in January 2025, Taiwan Semiconductor Manufacturing Co (TSMC), released a press statement reporting that it has commenced the manufacturing of 4nm chips in its production facility in Phoenix, Arizona. Gina Raimondo, the U.S. Secretary for Commerce, expressed her admiration for the company’s success and stated that the development will prove to be a major milestone in the country’s domestic chip production journey.

The final word

The semiconductor and electronics industry has experienced significant growth in the past few years owing to the gradual transition toward chiplet architecture and semiconductor sustainability. Additionally, the introduction of AI and quantum computing in the manufacturing and fabrication process is predicted to play a major role in the growth of the sector in the near future. Moreover, the launch of advanced products and the strategic alliances between leading companies are estimated to maximize the revenue share of the landscape in 2025.

Get in touch with our experts for latest advancements and upcoming trends in the domain!