Table Of Contents

- Key Trends Defining the Construction Scene in 2024

- Technological Advancements

- Companies to watch:

- Sustainability and Green Building Practices

- Modular and Prefabricated Construction

- Geographical Insights

- North America

- Europe

- Asia-Pacific

- Middle East

- Supply Chain Updates

- Raw Materials: Steel prices, which had risen by 15% in early 2024 due to global supply shortages, began to stabilize by Q3. This stabilization was primarily driven by an increase in local steel production in regions like Southeast Asia, which helped alleviate supply bottlenecks and restore market balance.

- Logistics: The integration of AI-powered logistics management systems led to a 12% improvement in delivery timelines, especially in Europe and North America. These systems optimized routes, reduced delays, and improved overall efficiency in both inbound and outbound supply chains.

- Labor Market: Global labor shortages, particularly in skilled construction workers, persisted throughout the year. However, initiatives such as vocational training programs in India and Germany demonstrated positive outcomes. In India, partnerships between construction firms and local governments helped train thousands of workers in advanced construction skills, while Germany’s apprenticeship programs also showed encouraging results in bridging the labor gap.

- Roadblocks and Their Solutions

- Raw Material Shortages: Raw material shortages were a significant challenge in 2024, particularly for steel and cement. However, companies adopted strategies to stabilize supply. Diversifying sourcing strategies helped mitigate risks, with firms like Tata Steel expanding their reach to new suppliers in Southeast Asia. Additionally, increased recycling efforts played a key role in addressing material shortages. For example, ArcelorMittal ramped up its use of recycled steel, which helped reduce dependency on raw material imports and alleviated some supply pressure by mid-2024.

- Labor Shortages: The global labor shortage in construction remained a challenge too, but several solutions were implemented to bridge the gap. Automation technologies like robotic bricklayers and 3D printing were deployed to reduce reliance on human labor. Notably, Germany’s “Skills for Tomorrow” program, which focuses on upskilling workers in emerging technologies, witnessed success in preparing the next generation of skilled labor for the industry. The program trained over 5,000 workers in the first half of 2024, improving labor availability and skill levels.

- Geopolitical Instabilities: Geopolitical tensions, particularly in regions like the Middle East and Eastern Europe, posed risks to the steady flow of goods and materials. However, initiatives like the EU’s trade pact with Southeast Asia helped ease some of these challenges. The trade agreement, finalized in early 2024, facilitated smoother imports of important construction materials such as timber and metals, and reduced tariffs on sustainable building materials. This collaboration ensured a more predictable and reliable supply chain despite global uncertainties.

- Verdict and Outlook

Sonia Mutreja

Koyel Ghosh

Construction and Manufacturing Industry Review 2024

Transformation is driving the construction industry, with technological advancements, a stronger focus on sustainability, and smarter project management leading the way. In 2024, cutting-edge tools like artificial Intelligence and Building Information Modelling have reshaped project execution, bringing both new opportunities and challenges for industry players. The demand for greener, modular solutions has gained momentum, making adaptability key to staying ahead.

However, 2024 has also brought challenges, including rising innovation costs, a shortage of skilled labor, and unpredictable supply chains. These issues have given way to creative solutions and offered valuable lessons that are shaping the future.

Looking ahead to 2025, the key question is how the lessons from 2024 will shape upcoming trends. This article looks at the key moments of the year, the insights gained, and how they establish the industry for the future.

Key Trends Defining the Construction Scene in 2024

Technological Advancements

Technological advancements are driving major transformations in the construction industry, impacting how projects are designed, managed, and executed.

One of the most impactful tools in 2024 is Building Information Modeling . BIM enables the creation of detailed 3D models that not only visualize a project but also enhance collaboration between architects, engineers, and contractors. These shared models help reduce communication gaps and minimize design errors, leading to fewer delays and more efficient resource use. BIM also improves material estimation, supporting sustainability efforts by reducing waste and cutting costs.

Artificial Intelligence is also playing a significant role in the construction sector. AI is used for design optimization, project management, and predictive analysis. Generative AI, in particular, allows for rapid generation of multiple design options, providing innovative solutions and speeding up decision-making. AI also contributes to project scheduling, cost estimation, and risk management by offering data-driven insights. Additionally, predictive maintenance powered by AI ensures better equipment performance, reducing downtime.

Drones and robotics are also revolutionizing the construction industry. Drones are used for site surveys, gathering real-time data, and creating detailed maps, improving project monitoring and accuracy. They reduce the need for workers in potentially dangerous areas, enhancing safety.

Companies to watch:

- Make a BIM: Founded in 2023 in Finland, Make a BIM uses AI to quickly convert 2D drawings into digital BIM models, significantly reducing manual labor.

- Infrakit : This cloud-based platform in Finland integrates BIM and GIS data, enabling real-time collaboration and data sharing among construction teams.

- XYZ Reality: XYZ Reality’s augmented reality headset allows construction workers to view holograms of BIM models on-site in the UK, improving construction precision and reducing errors.

- KTV Working Drone: Norway's KTV Working Drone specializes in using drones for high-rise window and facade cleaning, offering a safer and more efficient alternative to traditional methods.

- Drone Volt: France’s Drone Volt specializes in designing and manufacturing professional drones tailored for the construction industry, boosting efficiency and safety in tasks like inspection, surveillance, and mapping.

Sustainability and Green Building Practices

Sustainability and green building practices have become essential in the construction industry. With tightening environmental regulations and growing client demand for eco-friendly solutions, adopting sustainable materials and designs is key to reducing environmental impact and increasing project value.

A major trend in 2024 has been the use of eco-friendly materials. Construction is shifting toward renewable and sustainable resources like recycled steel, bamboo, and eco-concrete. These materials help lower the carbon footprint and align with green building certifications such as LEED and BREEAM. Using such materials not only supports sustainability but can also attract environmentally conscious clients, giving you a competitive edge.

Energy-efficient designs are gaining momentum as well. There is a growing emphasis on strategies that reduce energy consumption, such as passive solar design, which uses a building’s orientation and materials to regulate temperature naturally. High-performance insulation is also essential for minimizing energy loss, leading to lower operational costs for building owners. The integration of smart systems and IoT technology is becoming more common, allowing real-time energy management.

The drive toward net-zero energy buildings is gaining strength too. These buildings produce as much energy as they consume, aligning with global sustainability goals and helping you meet stricter energy regulations. Net-zero energy designs reduce long-term operating expenses for clients, offering a strong selling point.

Notable companies to monitor:

- ecopals : Ecopals in Germany Specializes in sustainable road-building materials by converting waste into eco-friendly construction products.

- Aedifion : Aedifion in Germany offers a platform for the digital decarbonization of buildings, optimizing energy consumption through data analytics.

- Betolar : Betolar in Finland develops low-carbon construction materials using industrial side streams, providing sustainable alternatives to traditional cement.

- Aisti : Aisti in Finlandproduces carbon-negative, recyclable, plastic-free acoustic tiles made from wood fiber, contributing to greener building interiors.

Modular and Prefabricated Construction

Modular and prefabricated construction methods are gaining popularity in 2024 due to their ability to accelerate projects, reduce costs, and improve quality control.

Modular construction involves assembling building components off-site in a controlled environment. This method allows for standardized production, speeding up timelines and reducing both labor and material costs. Manufacturing parts in a factory setting minimizes on-site construction activities, leading to fewer disruptions and delays. The predictability of modular construction helps meet deadlines and stay within budget.

A key advantage of modular construction is cost-effectiveness. Since modules are built to standardized specifications, economies of scale reduce the overall cost per unit, making this approach an attractive option for budget-conscious projects. Another significant benefit is quality control. Factory environments ensure precision and repeatability, meaning consistent quality throughout the project. Since components are produced under controlled conditions, errors are minimized, and variability is reduced compared to traditional construction.

Emerging players to keep an eye on:

- Flow Modules: Finland based Flow Modules focuses on industrializing housing production and improving prefabrication processes for cost-effective apartment construction.

- Modulous : Modulous in the UK Provides a platform that enables the design and delivery of modular homes without the need for factories, increasing home production.

- Logiprefab (Lithuania/Norway): Norway’s Logiprefab combines advanced production technology with modern construction methods to produce sustainable, economical panel-frame and modular houses inspired by Scandinavian traditions.

Geographical Insights

North America

The U.S. construction market thrived in 2024, particularly in commercial real estate, with a growth rate of 6%. This growth was driven by key infrastructure projects, including high-speed rail systems and renewable energy plants. Major U.S. companies like Bechtel and Fluor Corporation benefited from this surge, securing multi-billion-dollar contracts for energy and transportation infrastructure projects. Additionally, Turner Construction, a key player in the U.S., experienced a 7% increase in its commercial construction sector, fueled by a boom in office buildings, hotels, and mixed-use developments.

In terms of mergers and acquisitions, Skanska USA expanded its reach by acquiring Barclay White, a construction management company based in Philadelphia, for USD 13.5 million. This acquisition strengthed Skanska's footprint in the U.S. market, particularly in the mid-Atlantic region, allowing them to leverage Barclay White’s expertise in commercial construction and enhance its ability to manage large-scale projects in the Northeast.

Europe

Europe demonstrated resilience with a 4% growth in manufacturing output in 2024. Germany, a key player in the region, witnessed a notable 5% increase in exports of industrial machinery, particularly in automotive manufacturing and automation technologies. Siemens and Bosch took the lead, with Siemens securing significant contracts in the automation and digitalization of manufacturing processes across Europe.

In terms of mergers, Volvo Construction Equipment merged with Terex Corporation, combining resources to expand their market share in the construction equipment sector, particularly in eco-friendly and energy-efficient machinery.

Asia-Pacific

The Asia-Pacific region also experienced impressive growth in construction activities, registering a 7.5% increase in 2024. This was particularly evident in India and China, which experienced a surge in large-scale urban development projects, including smart cities and affordable housing initiatives. In India, companies like Larsen & Toubro and Shapoorji Pallonji secured multi-billion-dollar contracts for the construction of smart city projects, leading to a 9% increase in construction revenue.

China's urbanization efforts gained significant momentum, with China State Construction Engineering Corporation (CSCEC) reporting a 6% increase in construction activities driven by the expansion of infrastructure projects and urban housing developments.

Despite these gains, the region faced challenges such as fluctuating raw material prices. This was particularly evident in the steel market, where prices increased by 12% due to supply chain disruptions, impacting project costs in countries like Japan and South Korea.

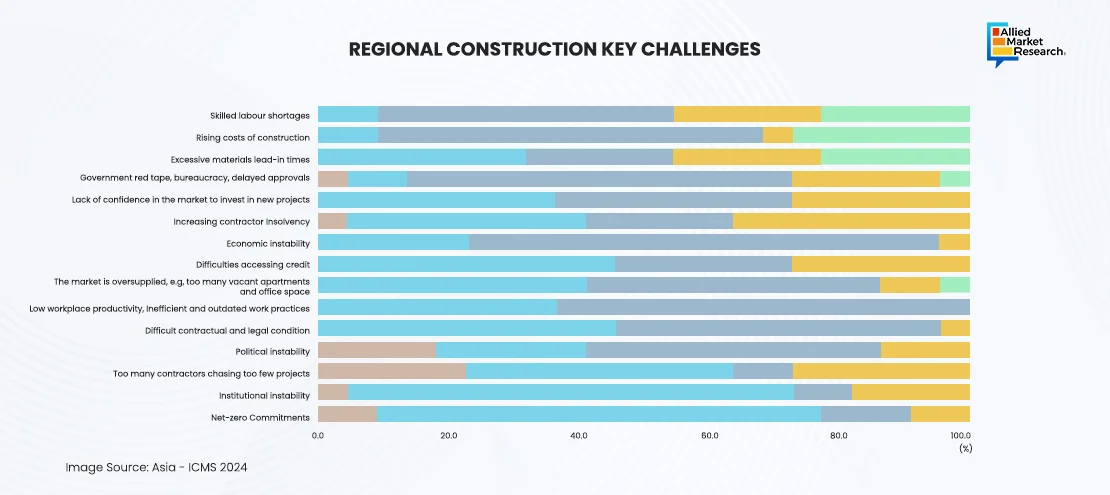

Figure: Asia: Regional Construction Challenges

Middle East

The Middle East faced several hurdles in 2024, including labor shortages and geopolitical tensions, which hindered construction activities. However, large-scale projects like Saudi Arabia’s NEOM city provided some positive momentum. The NEOM project, a $500 billion megacity, attracted significant investments, with companies like Saudi Binladin Group and Arabian Construction Company (ACC) leading key construction initiatives.

In addition, Emaar Properties in the UAE has maintained consistent growth, especially in the residential and mixed-use development sectors. However, the ongoing geopolitical issues in the region, coupled with labor shortages, slowed down the expected growth, leading to a modest 2% increase in overall construction output.

Supply Chain Updates

Supply chain disruptions, on the other hand, affected the construction and manufacturing industry in 2024, although there were notable improvements in the latter half of the year.

Raw Materials: Steel prices, which had risen by 15% in early 2024 due to global supply shortages, began to stabilize by Q3. This stabilization was primarily driven by an increase in local steel production in regions like Southeast Asia, which helped alleviate supply bottlenecks and restore market balance.

Logistics: The integration of AI-powered logistics management systems led to a 12% improvement in delivery timelines, especially in Europe and North America. These systems optimized routes, reduced delays, and improved overall efficiency in both inbound and outbound supply chains.

Labor Market: Global labor shortages, particularly in skilled construction workers, persisted throughout the year. However, initiatives such as vocational training programs in India and Germany demonstrated positive outcomes. In India, partnerships between construction firms and local governments helped train thousands of workers in advanced construction skills, while Germany’s apprenticeship programs also showed encouraging results in bridging the labor gap.

Roadblocks and Their Solutions

Raw Material Shortages: Raw material shortages were a significant challenge in 2024, particularly for steel and cement. However, companies adopted strategies to stabilize supply. Diversifying sourcing strategies helped mitigate risks, with firms like Tata Steel expanding their reach to new suppliers in Southeast Asia. Additionally, increased recycling efforts played a key role in addressing material shortages. For example, ArcelorMittal ramped up its use of recycled steel, which helped reduce dependency on raw material imports and alleviated some supply pressure by mid-2024.

Labor Shortages: The global labor shortage in construction remained a challenge too, but several solutions were implemented to bridge the gap. Automation technologies like robotic bricklayers and 3D printing were deployed to reduce reliance on human labor. Notably, Germany’s “Skills for Tomorrow” program, which focuses on upskilling workers in emerging technologies, witnessed success in preparing the next generation of skilled labor for the industry. The program trained over 5,000 workers in the first half of 2024, improving labor availability and skill levels.

Geopolitical Instabilities: Geopolitical tensions, particularly in regions like the Middle East and Eastern Europe, posed risks to the steady flow of goods and materials. However, initiatives like the EU’s trade pact with Southeast Asia helped ease some of these challenges. The trade agreement, finalized in early 2024, facilitated smoother imports of important construction materials such as timber and metals, and reduced tariffs on sustainable building materials. This collaboration ensured a more predictable and reliable supply chain despite global uncertainties.

Verdict and Outlook

Summing up, 2024 was a year of recovery and adaptation for the construction and manufacturing industry. While challenges such as labor shortages and raw material volatility persisted, innovations in technology and supply chain management helped mitigate many issues.

Looking ahead, 2025 is expected to grow even more, with sustainability and digital transformation continuing to dominate the agenda. Investments in green technologies and increased adoption of smart manufacturing processes are expected to drive the industry forward.

For detailed insights on these trends, refer to our below trending reports concerning the construction and manufacturing industry:

- Industrial Noise Control Market

- Smart Waste Management Market

- Biodegradable Cups Market

- Steel Processing Market

- KSA and MEA Busway-bus Duct Market

- Builders and Cabinet Hardware Market

- Adhesive Dispensing Equipment Market

- Railway Maintenance Machinery Market

- Prefabricated Construction Market

- One-Way Valve Market

For more updates on the CONMA domain, contact our experts today!